Tax-Exempt Organizations 101

Did you know that the term “nonprofit” is not always interchangeable with the term “501c3?”

A nonprofit is not always a 501c3, but a 501c3 is always a nonprofit. The term 501c3 is shorthand for an IRS term that describes public charities, which are most nonprofits. But there are also other kinds of nonprofits like 501c7 social clubs or 501c4 social welfare organizations.

A nonprofit corporation is an entity that is created for a charitable purpose—for example, your organization might be incorporated with the state as a volunteer-run food pantry. Similarly, churches, mosques, and other places of worship are automatically considered tax exempt by the IRS (as long as they meet certain requirements) without filing for 501c3 status officially. There are several benefits for churches who’d like to become 501c3s, but prior to going through the process with the IRS, they are considered a nonprofit organization only.

A 501c3 organization is a nonprofit organization that has officially been designated by the IRS as tax-exempt for its charitable purpose and programs. To gain tax-exempt status, organizations apply by filing either the form 1023 or 1023-EZ. There are several benefits to becoming a 501c3, including increased eligibility for grants, the ability to accept tax-deductible donations, and a credibility boost.

The primary difference between nonprofit status and 501c3 status can be found in two primary steps to starting a nonprofit: step one being incorporating with your state and step two being gaining tax exemption from the IRS. To summarize, incorporating in your state creates your nonprofit entity. Step two—gaining tax exemption from the IRS—makes you a 501c3.

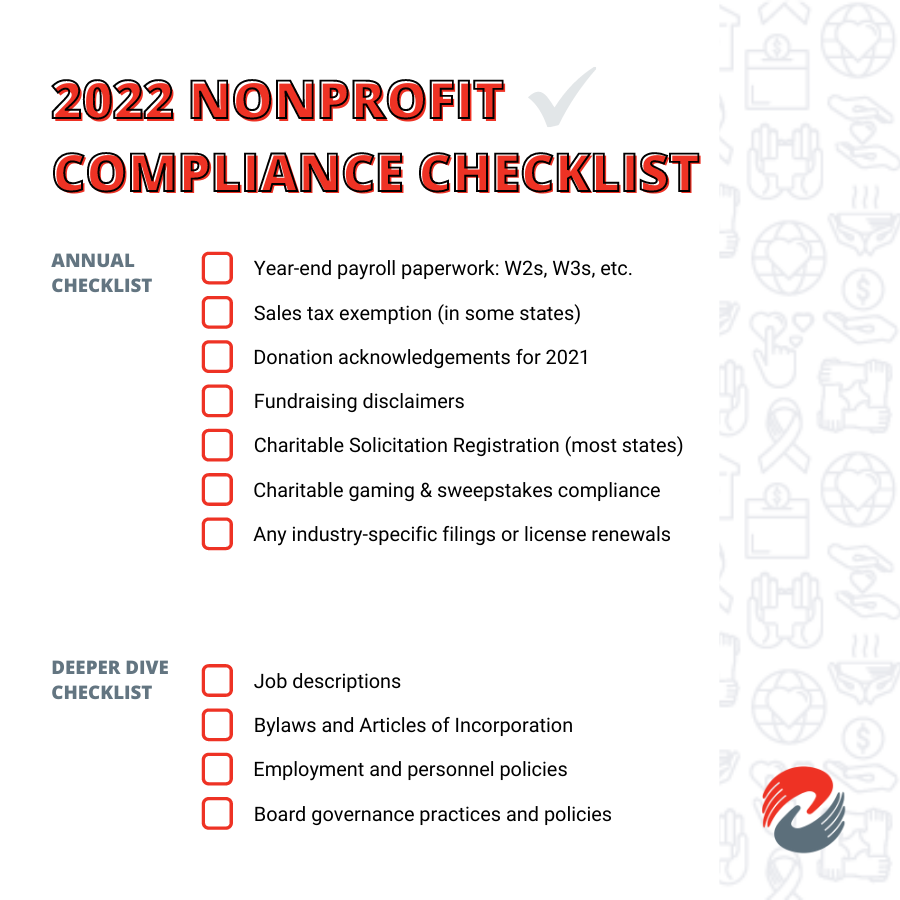

Once the IRS sends your determination letter recognizing your organization as a 501c3, there are also several obligations nonprofits must fulfill to make sure this status doesn’t get revoked. And there are several additional exemptions you won’t want to miss out on.

That’s why we compiled this list of frequently asked questions surrounding tax exemptions and deductions—so you can better serve your mission.

- Where can I find additional tax exemptions and discounts?

- If I’ve lost my 501c3 status, how can I get it back?

- Does my church need a 501c3 status?

- What do I need to provide to donors to ensure they can claim their tax exemption for donating?

- Can my donor take a tax deduction for in-kind donations?

- Are tax deductions allowed for restricted donations?

Where can I find additional tax exemptions and discounts?

One of the most common mistakes we see new nonprofits make is missing out extra tax exemptions and discounts. There are plenty of ways to save your nonprofit money if you know where to look. There are a wide variety of companies that offer discounts, including Google, Dropbox, Quickbooks and Salesforce.

For starters, each state has its own laws governing if nonprofits are exempt from paying sales tax, and many require you to apply for exemption for purchases made by the nonprofit. Have you checked on your state’s exemption laws?

If I’ve lost my 501c3 status, how can I get it back?

Nonprofits lose tax exempt status automatically after 3 consecutive years of not filing their annual return (also known as the 990). Loss of your tax exempt status in the eyes of the IRS renders your 501c3 status inactive, and this can prevent you from applying to certain grants and hinder fundraising efforts.

Luckily, there are four ways nonprofits can reinstate their nonprofit status. These methods vary depending on how long it’s been since your organization was revoked, whether or not it’s your first time being revoked, and some other determining factors.

It can be a difficult and lengthy process for newcomers to reinstate the status of their nonprofit organization, but with the help of a knowledgeable nonprofit attorney, the process doesn’t have to be daunting. Reach out to us for a free consultation to speak about which kind of reinstatement could be right for your nonprofit organization.

Does my church need a 501c3 status?

To put it simply, no, churches and other places of worship are not legally required to file for 501c3 status. While not all churches are registered 501c3 organizations, it is worth exploring if it could be right for you. There are several factors for churches to weigh when considering filing for 501c3 status that are unique to places of worship.

What do I need to provide to donors to ensure they can claim their tax exemption for donating?

Nonprofits are required to provide donation acknowledgements (also known as thank you letters) to donors, either virtually via email or as a physical letter. This ensures that when tax time rolls around, the donor has the information they need to take a tax deduction for their charitable contributions if they are able.

There are certain pieces of information that are required to be included on the donation acknowledgment, like your nonprofit’s tax ID number. You can read about the requirements and best practices in our free guide to writing donation acknowledgements.

Can my donor take a tax deduction for in-kind donations?

In-kind (or, non-cash) donations are gifts that fall into three categories:

- Direct payment by a donor of bill owed by the charity to a third party

- Donations of goods

- Donations of services

If a donor gives your homeless shelter 100 blankets, this would be considered an in-kind donation. Would this be tax deductible? And what are your obligations in response?

Generally, a donor may deduct an in-kind donation as a charitable contribution. And then, a donor must obtain a written acknowledgment from the charity to substantiate the gift, although the acknowledgment will generally not assign a dollar value to the donation.

Not only are the written acknowledgment requirements complex, especially for non-cash donations, but noncompliance can be costly (generally $10 per contribution).

By being attentive to these best practices for each type of in-kind donation, your organization can remain compliant and encourage even more donations from generous souls.

Are tax deductions allowed for restricted donations?

A restricted donation is when a donor asks for their funds to be used in a specific way. For example, if a family wants their donation to a summer reading program to be specifically used for children’s books, they want that donation to be restricted to activities or products that honor that request.

But can they also get a tax deduction on that donation? It depends. In order to protect nonprofits from becoming embroiled in a controversy surrounding a charitable gift, there needs to be clarity about which conditions and restrictions are permissible, and which may be too risky.

You’ll want to review these practical examples for guidance on how to navigate which types of restricted donations can be tax deductible.

Helping your Tax-Exempt Organization

The complexities of tax exemption and tax deductibility can be difficult for even the most experienced nonprofit leaders. If you need some guidance on how to keep your nonprofit organization compliant and thriving, request a consultation with a member of our legal team. We’d love to help your organization be the best it can be.