Would you like to convert an LLC into a nonprofit corporation? Let’s break down the ways to accomplish your goal. The answer isn’t the same in every state, but in our experience, there’s a straightforward way to go about getting tax exempt status. Whether you’re starting a new charitable program or you’re looking to accept grant funding, starting a nonprofit could be the move for your organization.

How do you convert an LLC into a nonprofit?

Most states don’t allow you to convert an LLC into a nonprofit directly, but there is still a way to accomplish your end goal. If you accidentally created an LLC instead of a nonprofit corporation, or if your objectives have changed and you’re ready to provide charitable programing, you can still get a nonprofit started. In the vast majority of cases, the fastest, cheapest way to go about it is to start from scratch. You’ll dissolve the LLC with the proper procedure in your state first. After that, you’ll likely still be able to use the name of the original LLC if that’s important for your organization. Next, you’ll go through the process of starting a new nonprofit organization. At this point, you’ll need to know what your charitable mission will be, including what charitable programs you’ll provide and who you’ll serve (also called a charitable class). It’s also a good idea to start recruiting board members, as nonprofit organizations are required to have at least 3 board members in most states. Once you’ve prepared the information you need, it’s time to file Articles of Incorporation (or your state’s equivalent form) with your state of choice. If your organization has people in multiple states involved, keep in mind, you’ll need to pick one state to initially incorporate. This doesn’t mean your organization is restricted to only working within that one state. In fact, many nonprofit organizations in the US work internationally as well! After incorporation, there are a few corporate documents your organization will need to ensure you’re compliant and ready to file for tax exempt status. We’ll cover those below. Your corporate documents will govern things like how your board operates and how the organization handles any conflicts of interest. You’ll also need an EIN, which will allow you to open a bank account in the organization’s name, and will later be tied to your tax exempt status with the IRS. The last step is to file for tax exempt status. For most organizations, you’ll file as a public charity (also called 501c3 organizations), but there’s also the option to organize as a private foundation. Or, if you’re starting an organization like a social club or a business league, you might want to pursue a different type of tax exempt status other than the 501c3 designation. Regardless of the type of organization, you’ll file the proper form for tax exempt status with the IRS, which is dependent on the purpose and size of your organization. These forms range from the 1023-EZ, a mid-size form that the IRS typically processes in 1-3 months, to the full form 1023 or 1024, which are more extensive forms that take longer to process. Keep in mind, the IRS does charge fees to file these forms, so factor that into your planning when budgeting.

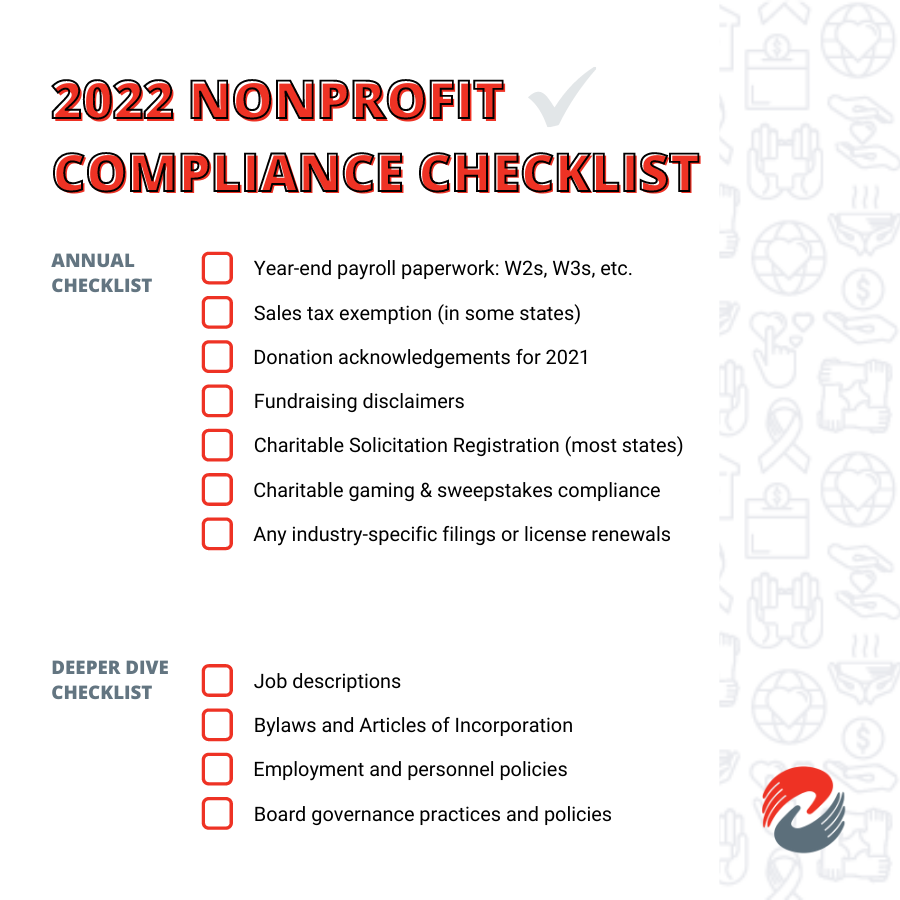

What documents will my new nonprofit need?

Typically, starting a nonprofit involves:

- Articles of Incorporation (or your state’s equivalent)

- An EIN

- Bylaws

- A Conflict of Interest Policy

- Organizational Actions

- The IRS tax exemption form (1023-EZ, 1023, or 1024)

It can also be helpful to develop additional planning documents like a funding plan that outlines how you’ll fund your mission, whether you’ll be applying for grants, organizing fundraising events, asking for individual donations, or charging program service revenue (or a combination of all of these methods).

Can you help me start the nonprofit?

Yes! Our team of nonprofit attorneys and professionals have helped start over 400 nonprofit organizations, so we’re happy to help. The process is simple. Reach out to us via our website or phone. Tell us a little about the mission of the nonprofit you’d like to start legally and we will match you with a member of our team for a free initial Zoom call. In that call, we’ll talk with you in more detail about the organization you’re looking to start and your goals. A Charitable Allies team member will give you an overview of the process, as well as information about the timeline and costs. After the initial call, we send over a detailed document about your project with us. You’d sign the document and provide the initial retainer payment when you’re ready to get started. Packages that include everything you need to start a nonprofit organization start at $1600.

Is there anything else I should know when converting an LLC into a nonprofit?

While we can’t provide an exhaustive list, there are some additional things to take into account when going from an LLC to a nonprofit. Many of these considerations are on a case-by-case basis, so please reach out to us if you have questions. If you already have a for-profit organization and the nonprofit will have a relationship with that organization in some capacity, there are various complex laws that come into play. Business activities are fairly common even in nonprofit organizations, but there are some activities that need to be kept within the for-profit business. Otherwise, the nonprofit’s activities might be subject to UBIT. UBIT stands for Unrelated Business Income Tax. Essentially, this is an additional tax on those activities even if the nonprofit organization is tax exempt. The process of starting a nonprofit can be rewarding, but also overwhelming if navigating the tax exempt landscape is new for you. We’re happy to advise on issues from UBIT to starting a nonprofit, so request a consultation with a member of our team when you’re ready to get started.

About

Charitable Allies is a nonprofit law firm that exclusively serves nonprofit organizations because we believe all nonprofits should have access to great legal counsel that doesn’t cost a fortune. We’ve helped over 1500 nonprofit organizations nationwide since 2013. Whether you’re starting a nonprofit, reorganizing, or solving board conflict, our nonprofit lawyers will provide the guidance you need to get back to what matters most: your mission.