Wondering how to start a nonprofit in Illinois? Our nonprofit lawyers helped hundreds of nonprofits get started legally, including getting 501c3 status. We’ve outlined the process step-by-step below. If you’d like our legal team to complete some (or all) of the process for you, request a free initial consultation. If you’re looking to start a 501c3 in Illinois or another type of tax exempt nonprofit, you’ve come to the right place.

How to Start a Nonprofit in Illinois Step 1: Prepare

The first step to starting a nonprofit in Illinois is the prep work. It’s not glamorous, but it’s needed. There are 3 key things to consider before you’re ready to start filing paperwork:

- Mission: What’s your charitable purpose?

- People: Who will be involved in making it happen?

- Funding: How much money will you need to get this nonprofit going?

Mission

First, choose what the mission of your nonprofit will be. What problem are you looking to solve? Who or what are you looking to help? The answers to those two questions will inform what your mission will be. Next, get more specific: think about how you’d like to help.

For instance, if I’d like to help the elderly in Peoria, there are several ways to go about it. I could pair up the elderly with local high school students who could come visit and build relationships with them. I could provide free home repairs to the elderly or wheelchair ramp installations. Or I could provide free care and programming for those struggling with memory loss. Any of these purposes are charitable, but when starting an organization, it’s good to narrow it down to one or two programs to start. You can always expand the amount of programs your nonprofit offers later.

People

You can’t start a nonprofit in Illinois by yourself! Every nonprofit must have a board of directors. The IRS requires at least three board members, the majority of whom are not related by blood or marriage. Basically this means your entire board can’t be made up of family members. The founder is absolutely allowed to be on the initial board of directors (and they often are). You are allowed to have board members that do not live in Illinois.

Your first board doesn’t need to be perfect, but they should be people who care about your mission and have the time to dedicate to helping start the organization. You’ll need a few of your board members to also be officers– like the Board Chair or Secretary. In Illinois, it is legal for one person to hold more than one officer position as long as your bylaws allow it. We typically suggest against having one person hold more than one office, in case of illness or something else that might prohibit them from performing their duties for a period of time.

Funding

Once you have your cause and your mission decided, it’s time to think about how the nonprofit will be funded. Even if you’re starting small, there are always costs to starting a nonprofit. We’ll outline how much it costs to start a nonprofit in Illinois below. The costs outlined in that section are the normal filing fees, but you’ll also want to take into account what it will cost to actually run your program day-to-day. Think about how much your organization will need to spend on:

- Materials to run your program

- Hiring any staff to run the program

- Office and administrative costs like a printer or payroll tax

- Vendor to help you with startup paperwork (if desired)

- A website or other branded materials to get the word out there

- Fundraising events to raise donations

- Any services you or your board or volunteers are not able to provide like accounting

How much does it cost to start a nonprofit organization in Illinois?

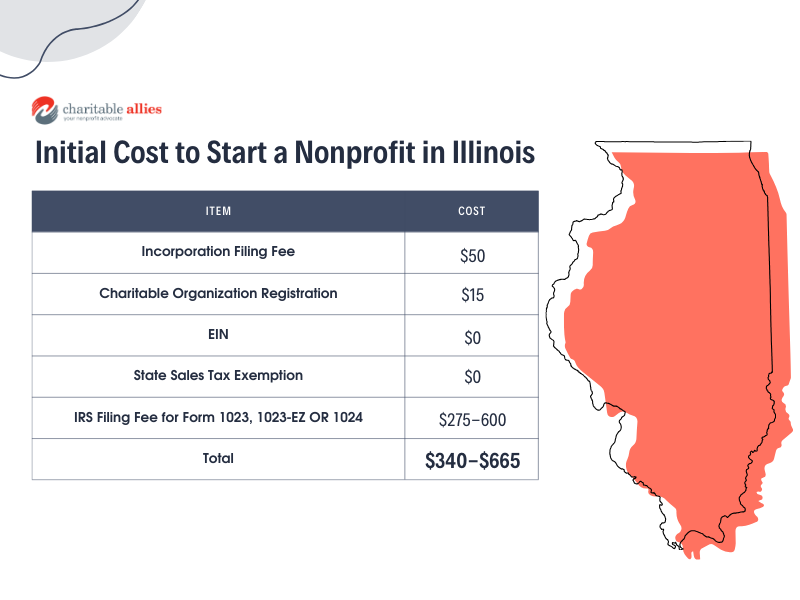

Before you start a nonprofit organization in Illinois, here are a few costs you’ll run into, regardless of what type of nonprofit you want to start:

- Incorporating in Illinois: $50 filing fee with the Illinois Secretary of State

- Illinois Charitable Organization Registration: $15 for the initial filing

- EIN Filing Fee: $0

- State Sales Tax Exemption: $0

- Filing with the IRS for tax exempt status: $275-$600 (see below for details)

Total: $340-$665

If you’d like an experienced legal team to create your charitable organization for you, or would simply like help getting 501c3 status, reach out! Our team works exclusively with new and existing nonprofits and would love to help.

How to Start a Nonprofit in Illinois Step 2: Incorporating with the State

Now that you’re ready to start the legal process, incorporating with the Illinois Secretary of State is the next step. Come up with a name for your nonprofit. First, you’ll want to make sure no other organization in Illinois is already using the name you’d like to call your nonprofit. To search if your proposed name is in mind, check their website. Keep in mind, Illinois does not allow certain political phrases or words within the name of your nonprofit, and with some types of organizations, they require the name of the organization to end with the letters NFP. Fun fact: Illinois is one of the few states that allows you to reserve a name in advance. So if you’re not quite ready to file paperwork yet, but you want to reserve your name, you can file a form to do so. The filing fee is $25 and will save the name for you for 90 days.

The filing fee for the document is $50 and usually, the approval or denial will come through within 1-2 weeks. Illinois does have an expedited option, which allows you to pay $25 to have your application processed in a quicker time frame. Note that the expedited fee must be paid in-person.

What will you need to include in the Illinois Not-For-Profit Articles of Incorporation?

- Name of the nonprofit

- Nonprofit address (many people use a board member’s to start with)

- Purpose of the nonprofit (your mission)

- The names of your board members (you must list at least three board members, but cannot list more than seven)

- Contact information and mailing information for the person who will be the registered agent (The person who will receive mail on behalf of the nonprofit)

- If you will have members or not (Note: This is different from having board members. Most nonprofits do not have members.)

- Dissolution language (what happens to the nonprofit’s assets if it were to ever dissolve)

Make sure your “statement of purpose” accurately reflects your nonprofit’s charitable activities. It’s crucial you use language in the document that is in-line with what the IRS recognizes as charitable. You’ll need to be specific enough that they know your organization is charitable without being so specific that it would limit you from being able to expand your programs if the need arises.

How to Start a Nonprofit in Illinois Step 3: Create your Corporate Documents (Including Bylaws)

Corporate documents include your EIN, bylaws and conflict of interest policy. You’ll need all of these documents in order to stay in-line with local and federal laws that govern nonprofits. Organizations doing charitable work internationally will also need an OFAC compliance policy, which we’ll discuss below.

EIN

An EIN is a unique number the IRS attaches to your nonprofit. Similarly to how a social security number is attached to an individual person during their entire life, the EIN follows the nonprofit around for its entire lifecycle. The EIN is required for the nonprofit to open a bank account, accept donations and/or hire employees. There is no fee to file for an EIN with the IRS. The EIN must be on every donation acknowledgment you send once your nonprofit starts receiving donations.

Bylaws

Nonprofit organizations are governed by an official set of rules called bylaws. Bylaws are legally binding, so this is not the place to put lofty goals. Make your bylaws easy to understand and follow, making things clear without being hyper specific. For example, some nonprofits stated in their bylaws that for board meetings to be valid, they must happen in person. During 2020, that became an issue for many organizations, so many had to scramble to amend their bylaws to allow for Zoom meetings and voting over Zoom or email.

Here are a few examples of questions the bylaws should answer:

- How long is a board member’s term? (how long they serve on the board)

- What happens if the nonprofit were to ever permanently close?

- When does the nonprofit’s fiscal year start and end?

- What rights and responsibilities do members have? (if applicable)

Bylaws are often fairly standard documents that don’t include a ton of mission-specific information in new organizations. As your nonprofit grows and changes though, you might have to update your bylaws a few years down the line. That’s perfectly normal for a growing nonprofit organization.

Conflict of Interest Policy

The conflict of interest policy outlines what a conflict of interest is, how to determine if there is a conflict present, and how to handle it. It should be clear enough in defining the proper terms that you can identify potential conflicts easily. If a potential conflict is identified, the document will walk you through how to handle it to ensure the nonprofit’s 501c3 status isn’t being put at risk.

OFAC Compliance Policy

If your organization is going to do any work in another country, you’ll also want an OFAC Compliance policy. OFAC stands for Office of Foreign Assets and Control, and it’s the US government’s way of making sure that any US agencies operating internationally are following their guidelines. You can read more about operating a US-Based nonprofit internationally here.

How to Start a Nonprofit in Illinois Step 4: Apply For Tax Exemption (or 501c3 status)

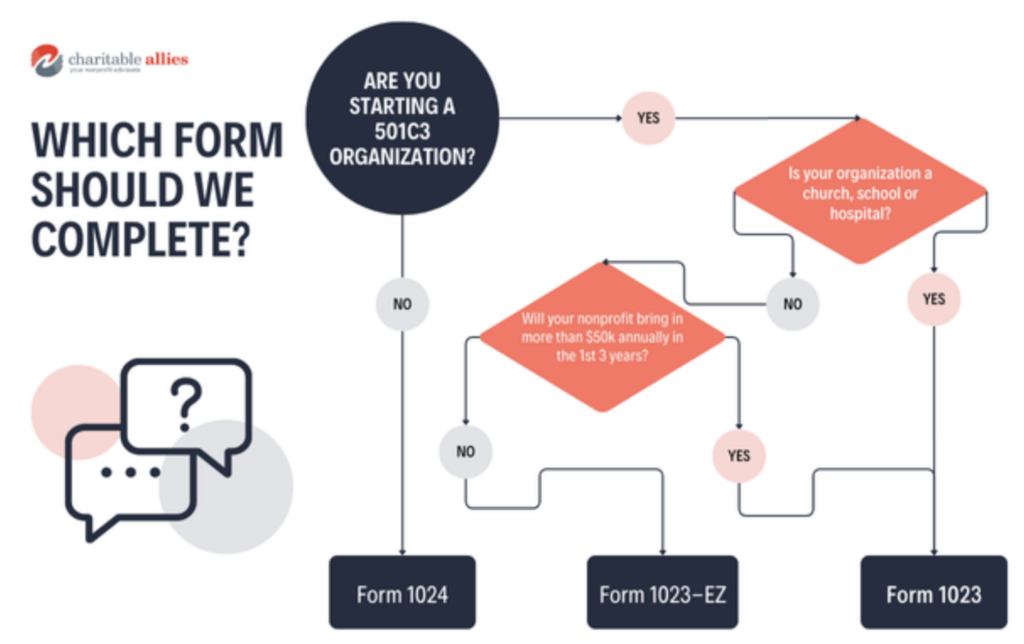

When it comes to starting a nonprofit in Illinois, applying for tax exempt status is one of the most important steps. Some people call tax exempt status 501c3 status (or 501c4, etc. depending on the type of organization). All 501c3 organizations are nonprofits, but not all nonprofits are 501c3 organizations. Our experienced legal team is happy to help with filing for tax exempt status no matter what kind of nonprofit or foundation you’d like to start. Find out which form you should file when you start a nonprofit in Illinois in the flowchart below. All of the forms are filed with the IRS to gain a determination letter, which is a letter they send to prove your organization is a tax exempt nonprofit. You’ll want to keep that determination letter because you’ll need it throughout the nonprofit’s lifecycle for everything from getting discounts from vendors to proving your charitable status to grant providers.

Form 1023

Form 1023 is the one of the most common applications for tax exempt status. Form 1023 is varied in length, depending on the type of organization you’re starting. Different types of organizations may be required to fill out different sections of the form. For example, schools have their own section on the form that asks more specific information about their school. Overall, Form 1023 is an extensive document that will ask all the important information about your nonprofit, from A to Z. Form 1023 includes a budget section where you’ll need to create a projected budget for the organization. The IRS charges $600 to file the form. Currently, the IRS takes 6-9 months to process Form 1023, but you can always check current processing times here.

Form 1023-EZ

If you’re not starting a hospital, school, church, or non-c3 organization, you might be eligible to file form 1023-EZ. Form 1023-EZ is a shorter version of the 1023 that the IRS created for smaller nonprofits just getting started. However, there is a limit to who can file this form. If your organization is expecting more than $50,000 in revenue (including donations, program service revenue, etc.) annually within your first three years, you’ll need to file Form 1023.

But for many people, the EZ form is a cheaper, faster way to gain 501c3 status for your nonprofit. Some vendors will try to scare organizations away from filing the 1023-EZ because it is a less expensive option, but if your nonprofit meets the requirements, there is no real reason to not file this form. The filing fee is $275, rather than $600 for the full Form 1023. The processing time on Form 1023-EZ is only 1-2 months.

Form 1024

If you’re wondering how to start a nonprofit in Illinois that is not a 501c3, you’ll need Form 1024. Form 1024 is for you if you’re starting:

- A social welfare organization (501c4)

- A social club (501c7)

- A business league (501c6)

- A cemetery (501c13)

- A lodge or fraternal organization (501c8 or 501c10)

- Any other type of tax exempt organization that is not a 501c3

Keep in mind, the vast majority of nonprofits are 501c3s. The IRS charges $600 to file Form 1024. The IRS is currently taking 7-10 months to approve Form 1024, but you can always check their processing times here.

How to Start a Nonprofit in Illinois Step 5: Additional Filings

In Illinois, there are a few additional filings to think about if you’re in the process of starting a nonprofit. First, you’ll likely want to take care of your initial registration with the state. Your initial registration is what allows you to operate as a charitable organization and fundraise legally in Illinois. The filing fee is $15 and they have a short form you’ll need to complete.

If you’re looking to save money, think about sales tax exemption. If your nonprofit will be making any purchases at all, sales tax exemption will allow your nonprofit not to pay the state’s sales tax on any purchases made for the organization. It’s free to file for sales tax exemption in Illinois.

Every nonprofit is different, so you will need to think through the other potential policies andc documents you want to have in place. If you’re working with a vulnerable population like animals or children, we’d suggest having solid safety policies in place. Or if you regularly use volunteers, you’ll want a volunteer agreement to ensure volunteers are clear on expectations, rules and to lessen the likelihood of a potential lawsuit from a volunteer. Think about who will be involved with your nonprofit and any potential risks. Those two things will usually give you a good starting point in figuring out what kinds of documents you’ll need to keep your program running safely and smoothly.

We’ve helped tons of nonprofits from Chicago to Carbondale get started. If you are ready to start a nonprofit in Illinois, reach out to us and we’re happy to help!

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025

- Legal Advice for Nonprofits: When to Get Help and What’s at Stake - October 15, 2025