When setting up a 501c3 it can be confusing how much money you should spend and what to spend that money on. Often you’re left questioning how much does it cost to set up a 501c3? The good news is that this article lays it out for you in an in-depth breakdown of all the important costs you should consider. For further help with starting your nonprofit, request a free consultation here:

How much does it cost to set up a 501c3? | Incorporation fees

One of the first things you’ll need to pay for for your nonprofit is an incorporation fee. Incorporating with your state can sometimes be a complicated process so if you need help reach out! We find that people often don’t take into account what the IRS requires when creating their Articles of Incorporation. For those who don’t know, Articles of Incorporation are like the birth certificate of your organization. When you start your nonprofit you need to file your Articles of Incorporation to create the organization on a state-level.

Articles of Incorporation Fees

The cost for filing your Articles of Incorporation varies widely from state-to-state. The lowest filing fee can be found in Kentucky at just $8. On the other hand, the state with the highest fee is Maryland which is $226.60. But don’t worry, most states aren’t this expensive. The typical range you’ll find is between $20-$100. Take a look at the graph below showing the estimated fees. We’ll be tallying up these costs as we go along in this article.

| Name of Fee | Estimated Fees |

| Articles of Incorporation | $20-$100 |

Expedited Fees (optional)

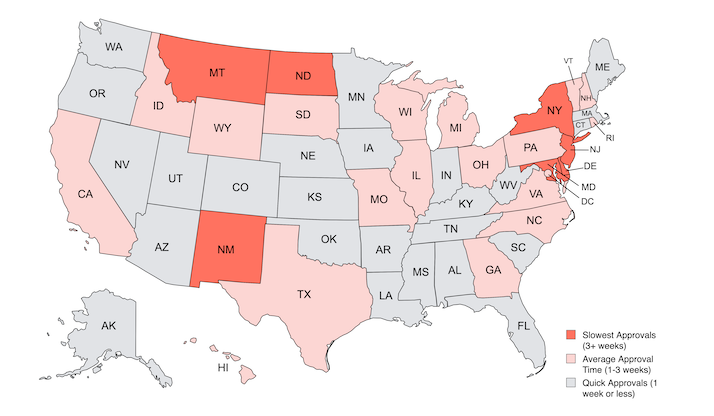

Let’s say you’re in a time crunch and need your Articles of Incorporation back faster than the typical processing times. If this is you, you’re in luck. In most states, you have the option to expedite your Articles of Incorporation. If you’re wondering if you should expedite your filings take a look at the mapgraph below which outlines the expected wait times of filing your Articles of Incorporation. For most organizations this isn’t necessary, but for those who want a quicker processing time, you can pay an expedite fee with your state to speed up the process. The lowest expediting fee you can find is in Massachusetts which is only $6 and is actually included in your original incorporation fee. The highest fee is $1000 and this is in several states (Georgia, Nevada, New Jersey, Michigan, New York, Ohio, Pennsylvania, and West Virginia). For most states, you can expect the cost to be around $25-$200. We won’t be adding this to our graph because it’s an optional cost most nonprofits don’t need. If you decide to expedite, you should make sure to add this cost in addition to the other costs we cover. To find the cost specific to your state visit your state’s Secretary of State website and look at the expedited fees for your filing.

Additional costs to consider when filing

There are a few additional costs that are specific to certain states when filing your Articles of Incorporation. For example, if you live in Texas there’s a search fee to check if any other entity in your state holds your name. It’s only $1. Texas is the only state with a search fee currently. One fee you could incur is an initial report fee, which is a report that provides your state with basic information about your organization. A majority of states don’t require an initial report fee, but for those who do, on average it can cost you anywhere between $10-$100.

Which State is the Cheapest? Which State is the Most Expensive?

Depending on the type of nonprofit you’re starting, typically Kentucky is the least expensive state. In Kentucky, you can start a nonprofit entity for $8 on the state level and they do not require fundraising registration, though there are additional expenses at the federal level. Maryland is the most expensive state. In Maryland, incorporation alone costs over $200 and they require an additional registration to fundraise legally. But no matter the cost, we suggest starting your nonprofit in the state you’ll be performing most of the charitable work.

How much does it cost to set up a 501c3? | Charitable Solicitation Registration

Charitable solicitation registration (CSR) is a complicated way of saying your organization might need to register with your state to request donations. Not every state requires this and we have a whole article outlining CSR: what CSR is and which states have this requirement. But when it comes to cost, we’re happy to note a lot of states don’t charge anything. But for those that do, commonly the cost will be around $25. The highest fee you could pay is $412.50 in Washington D.C., but this is a pretty big outlier when it comes to other states. Remember this estimate is based on one state, if you want to solicit in multiple states you’ll have to register in the other states that require CSR. Let’s go back to our graph and add this cost.

| Name of Fee | Estimated Fees |

| Articles of Incorporation | $20-$100 |

| Charitable Solicitation Registration | $25 |

How much does it cost to set up a 501c3? | Filing with the IRS for tax-exempt status

To get tax-exempt status you need to file one of the following forms. These forms can often be overwhelming for people who are new to them. If you’d like help filing these forms, reach out to us!

Form 1023

Form 1023 is a form typically used by larger nonprofits. Any organization expecting over $50,000 in annual revenue or having assets over $250,000 in the first 3 years should fill out this form. Churches, schools, and hospitals are also required to file Form 1023. The filing fee for Form 1023 is $600. The wait time to get your exemption status back is typically around 6-10 months so make sure to prepare these filings accordingly.

Form 1023-EZ

Unlike Form 1023, form 1023-EZ is a form nonprofits can fill out if they aren’t expecting $50,000 in annual revenue and don’t have assets over $250,000 within the first three years. This form is cheaper, only costing $275, and is highly recommended if you meet these requirements. A quick note to remember is that there is no added benefit to filing Form 1023. Meaning Form 1023-EZ is a cheaper alternative and only takes 2-4 weeks to process.

Form 1024

Form 1024 is great for other types of tax-exempt organizations like:

- Social welfare organizations (501c4)

- Labor agricultural organizations (501c5)

- Business leagues (501c6)

Like Form 1023 and Form 1023-EZ, Form 1024 requires detailed information on your organization: its activities, governance structure, and financials. The filing fee for Form 1024 is $600 with a processing time of 7-10 months.

Taking these costs into account, you’ll either pay $275 or $600. Let’s go back to our graph and add these costs.

| Name of Fee | Estimated Fees |

| Articles of Incorporation | $20-$100 |

| Charitable Solicitation Registration | $25 |

| IRS Tax-exempt Status | $275 or $600 |

For more information about each form check out our article on how to start a nonprofit.

How much does it cost to set up a 501c3? | Additional costs

When setting up a 501c3, there are many additional costs that might come your way. For instance, if you’re starting an animal shelter you need to think about your supplies such as dog food. If you’re starting a church you need to think about the utility bills for your building. These costs are all important to remember and should not be forgotten when asking yourself “how much does it cost to set up a 501c3? ”Think about the who (volunteers, staff or vendors), what (supplies to run your programs or throw events) and where (rent or mortgage) of your charitable programs to find basic costs you’ll need to think about.

Another potential cost is sales tax exemption. A majority of states don’t require this and if they do, most don’t charge for sales tax exemption. But if they do charge for sales tax exemption, it varies depending on the year and is ever-changing. For example, in Illinois you may have nominal fees you have to pay, depending on the year. If you want to apply for sales tax exemption check your Secretary of State’s website to see any potential costs.

Note: Your employer identification number (EIN) is required when starting a nonprofit, but it is free of charge.

Can I Start a Nonprofit With No Money?

No, you cannot start a nonprofit organization legally for free. Instead, try volunteering with existing nonprofits in your area while you gain experience and form relationships with people who care about the cause you’d like to serve. Building relationships is the first step to fundraising. You can also apply for a job with an existing nonprofit organization in your area that serves a cause you care about. The lowest cost way to start your own organization is often fiscal sponsorship, which requires your nonprofit to sit under the umbrella of another 501c3’s status and doesn’t include full independence.

How much does it cost to set up a 501c3? | Summary of Costs

|

Name of Fee |

Estimated Fees |

|

Articles of Incorporation |

$20-$100 |

|

Charitable Solicitation Registration |

$25 |

|

IRS Tax-exempt Status |

$275 or $600 |

|

+ |

|

|

Additional Costs |

|

|

= |

|

|

Total |

+/- $320-$700 |

Calculating out these numbers you can see that on average you can expect to spend anywhere from $320-$700 to start your nonprofit at a base level, not including any program-specific costs. Now this can vary heavily depending on your state, its requirements, and what tax form you decide to file. If you file in Kentucky, your Articles of Incorporation costs $8, there is no CSR fee, and if you file for Form 1023-EZ for $275 your total cost could be as low as $283. Or if you live in Washington D.C. you have an initial fee for nonprofits which is $80, Articles of Incorporation costs $99, CSR costs $412.50, and if you file for Form 1023 for $600 your cost can be as high as $1191.50.

Now that we’ve answered the question how much does it cost to set up a 501c3, we want to further help you! One of the largest costs individuals often forget about starting a nonprofit is the time and effort it takes. And the costs can be higher if mistakes are made throughout the process. It’s always cheaper to get it done right the first time than having to go back and file additional paperwork to fix mistakes. If you want help in starting your nonprofit don’t hesitate to reach out and schedule a free consultation with our team!

- Guiding Your Nonprofit Towards Success with Board Goals - November 13, 2025

- Nonprofit Succession Planning: How to Protect Your Mission Long-Term - October 29, 2025

- Background Check Volunteers and Other Safety Considerations for Nonprofits - July 24, 2024