Wondering how to start a nonprofit organization in Kentucky? Our attorneys helped hundreds of nonprofits get started nationwide, so we’re here to help. Let’s walk through the process step-by-step below. If you’d like our legal team to complete some (or all) of the process for you, request a free consultation. No matter what type of nonprofit you want to launch– whether you’re getting a 501c3 or a 501c7 off the ground, the process below will give you a general idea of what to expect.

How to Start a Nonprofit in Kentucky Step 1: Preparation

To start a nonprofit organization in Kentucky, you’ll need to do a little prep work. There are 3 key things to think about before you get the ball rolling:

- Mission: What’s the goal of the nonprofit?

- People: Who is going to help you make this happen?

- Funding: How much money will you need to get started?

Mission

First ask yourself: what will the purpose of your charitable program be? You’ll need to know who or what you’ll be serving, which is often called the charitable class. The charitable class for your nonprofit could be first responders, children with autism, a rare type of butterfly, a historic site, etc. The group or place you serve should be defined but not limited to a tiny group like one family or one person.

Next, think about how you’d like to serve that charitable class. For example, if you’d like to help stray dogs in Owensboro, there are several options. You could provide safe, loving homes to these pups. Or maybe your focus will be on providing medical care to any strays who are hurt or sick. Either these purposes are charitable. When you go to file the paperwork, you’ll need to have an idea of what your program(s) will be. Typically, organizations start with one or two programs, then if you’d like to create more programs to support your mission later, you can.

People

Every nonprofit needs a board of directors. When you start a nonprofit in Kentucky, the IRS requires at least three board members. Board members can’t all be related by blood, marriage, or through owning a separate business together, unless you’re starting a private foundation. However, you can have some relatives on the board. You simply need to have enough other people to outvote the people who are related.

Your first board won’t be perfect, but it should be made up of people who care about your mission and are able to handle the commitment of being on a board for a few years. A few board members will also be officers– like the Treasurer or Secretary. In Kentucky, it is legal for one person to hold more than one office. We typically suggest against that, just in case a board member is sick or unable to perform their duties for a period of time.

Funding

Once you have your cause in mind and you have three board members lined up, it’s time to think about how the nonprofit will be funded. Even if you’re starting small, there are always costs associated with starting a nonprofit. Nothing is free. Many people ask family, friends and their new board members for help with funding the initial costs. Others fund the startup out of their own pocket. Keep in mind, most grant providers are not willing to cover startup costs.

Take into account what you’ll need to effectively run your program on a day-to-day basis. But understand that there are costs to getting started as well. Here are a few potential costs to consider:

- Cost of materials to run your program

- Cost of administrative supplies like printing costs or any software you might need

- Cost of vendor to help you with startup paperwork (if desired)

- Cost of creating a website or other branded materials

- Cost of any sort of fundraising events

- Cost of any services you or your board or volunteers are not able to provide like accounting

- Cost of hiring qualified staff (if applicable)

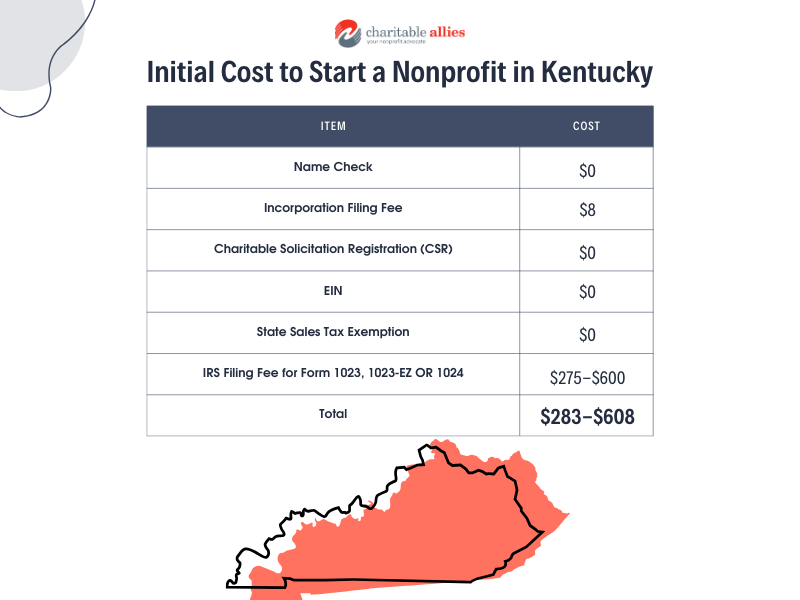

How much does it cost to start a nonprofit organization in Kentucky?

When you’re learning how to start a nonprofit in Kentucky, it’s important to take the cost of the initial paperwork filings into account. Kentucky has one of the lowest incorporation filing fees of any state! Here are the basic costs that will apply to starting a nonprofit in Kentucky:

- Incorporating in Kentucky: $8 filing fee with the Kentucky Secretary of State

- Charitable Solicitation Registration: $0, but you do need to file with the Kentucky Attorney General

- EIN Filing Fee: $0

- State Sales Tax Exemption: $0

- Filing with the IRS for tax exempt status: $275-$600 (see below for details)

Total: $283-$608

How to Start a Nonprofit in Kentucky Step 2: Incorporation

After you’ve prepared, the first step in the legal process is incorporating with the Kentucky Secretary of State. Incorporating is a straightforward process, but there are factors to keep in mind if you want to get it done properly. Before you file, check that no other organization in Kentucky is already using the name you have in mind for your organization.

Keep in mind, all nonprofit organizations in Kentucky need to have a suffix. That suffix should be Inc., Co., or LTD. or the full spelling of one of those terms. You’ll file Articles of Incorporation. The filing fee for the document is $8 and usually, the approval or denial will come through within 1 business day unless you file by mail. We don’t suggest filing by mail because the approval will take longer to come through.

If you’re looking to have someone complete the process of starting a nonprofit organization in Kentucky for you, please let us know! We are happy to help. Our comprehensive packages start at $1550, including these filing fees.

What information is in the Kentucky Articles of Incorporation for Nonprofits?

- Name of the nonprofit

- Nonprofit address (many people use a board member’s to start with)

- Purpose of the organization

- Registered agent name and address (the person who will receive official mailings on behalf of the organization)

- The name and address of your board members

- Dissolution language (what happens to the nonprofit’s assets if it were to ever dissolve)

It’s key that the language you use in this document is in-line with what the IRS recognizes as charitable, especially in the purpose statement. You’ll need to be specific enough that they know your activities are charitable without limiting you from being able to expand your programs if you’d like to in the future.

How to Start a Nonprofit in Kentucky Step 3: Bylaws & Corporate Documents

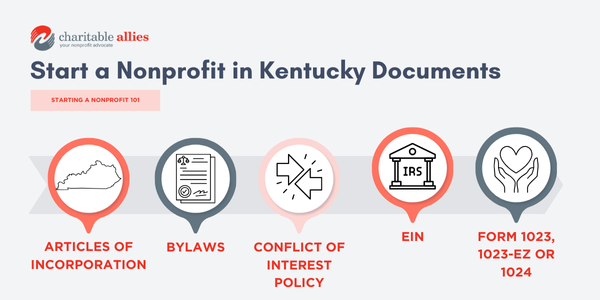

We group the next few documents into one step called the corporate documents. In this step, you’ll need bylaws, a conflict of interest policy and an EIN. If your nonprofit will be doing international work, you’ll also need an OFAC compliance policy.

EIN

The EIN is a unique number the IRS attaches to your nonprofit that will follow your nonprofit around for its entire lifecycle, much like a social security number is attached to an individual. You’ll need an EIN to open a bank account in the nonprofit’s name or hire employees in the future. There is no fee to file for an EIN. The EIN must be on every donation acknowledgment you send when your nonprofit starts receiving donations.

Bylaws

Bylaws are legally binding rules the nonprofit needs to follow. Each state has their own requirements for what should be included in the nonprofit’s bylaws and the IRS has its own set of rules for nonprofits as well. It’s key to make yours abide by these requirements while remaining easy to understand and follow. Bylaws determine how decisions are made, conflicts are resolved, and risks to the nonprofit are avoided. When it comes to legal concerns, it’s your bylaws that have the final word. Your bylaws should include information about 3 key topics: your board, members (if you have them, this is different from board members), and money.

Here are a few examples of questions the bylaws should answer:

- How long will board members serve on the board?

- What happens if the nonprofit were to permanently close?

- When does the nonprofit’s fiscal year start and end?

- What rights and responsibilities do members have?

This list doesn’t cover all the requirements but should get you thinking in the right direction. If you’d like our attorneys to draft a set of bylaws for you, let us know. We’ve helped hundreds of nonprofits start successfully nationwide.

Conflict of Interest Policy

The conflict of interest policy outlines what a conflict of interest is, how to determine if there is a conflict present, and how to handle it. It should be clear enough that you can identify potential conflicts easily. If you suspect a potential conflict of interest, the document will walk through the proper procedure to handle it to ensure the organization’s tax exempt status isn’t being put at risk.

OFAC Compliance Policy

If your organization is going to do any work outside the US, you need an OFAC Compliance policy. OFAC is the Office of Foreign Assets and Control, and it makes sure that any US agencies operating internationally are following the guidelines set by the US government. This includes things like sanctions against working in certain areas or with specific people or groups. Read further details about US nonprofit operating internationally here.

How to Start a Nonprofit in Kentucky Step 4: Apply For Tax Exempt Status

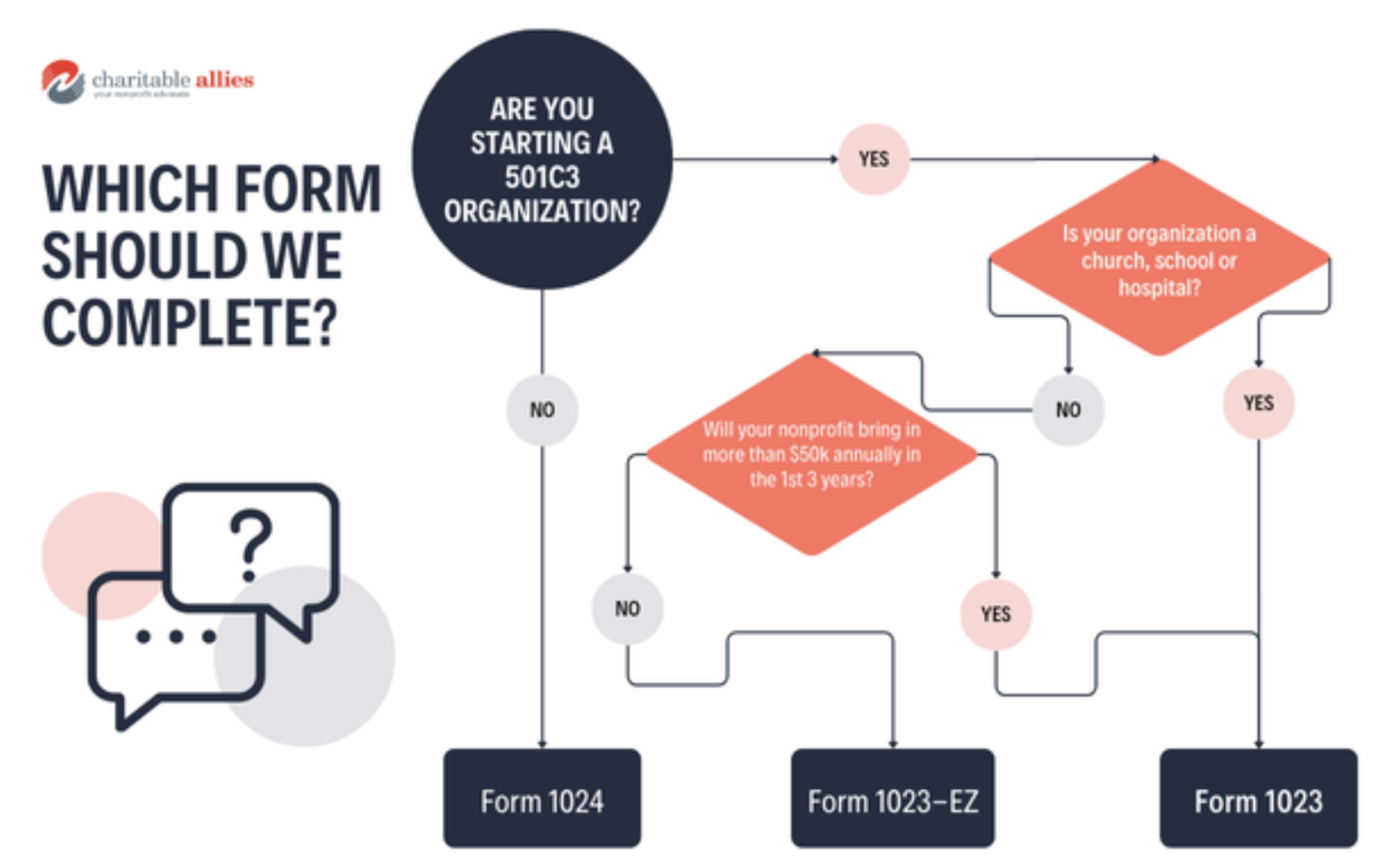

The most well-known step in the process of how to start a nonprofit in Kentucky is to apply for tax exempt status. Tax Exemption is often nicknamed “501c3 status” or “getting your determination letter.” But remember: all 501c3 organizations are nonprofits, but not all nonprofits are 501c3 organizations. Regardless of the type of nonprofit you want to start, we are able to help with any of the three forms we’ll detail below. Find out which form you should file when starting a nonprofit in Kentucky in the flowchart below. All three forms are filed with the IRS.

Form 1023

If you’re starting a 501c3 organization, you might be filing IRS Form 1023. Form 1023 is varied in length, depending on the type of organization you’re starting. Different types of organizations may be required to fill out different sections. For example, there’s a specific schedule for schools. But overall, the form will ask extensive questions about your nonprofit, including estimated budget information for your first few years of existence. The filing fee for Form 1023 that the IRS charges is $600. Typically, the IRS takes 6-10 months to process the form, but you can always check current processing times here.

Form 1023-EZ

If you’re not starting a hospital, school, church, or non-c3 organization, you might be eligible to file form 1023-EZ. Form 1023-EZ is a shorter version of the 1023. Filing the 1023-EZ will get you the same 501c3 status as the 1023, but the form is much shorter and cheaper to file. The filing fee is $275, rather than $600 for the full form 1023. The processing time on Form 1023-EZ is about 1-2 months, which is about 5-7 months shorter than the full 1023 timeline.

The IRS does have requirements for organizations completing the 1023-EZ though. If your organization is expecting more than $50,000 in revenue (including donations, program service revenue, etc.) annually within your first three years, you’ll need to file the full Form 1023. But for many people, the EZ form is a cheaper, faster way to gain 501c3 status for your nonprofit. The status you received is the same tax exempt status and it can allow your organization to get off the ground faster.

Form 1024

If you’re wondering how to start a nonprofit in Kentucky that is a 501c4, or any other type of non-501c3, you will not file form 1023. Instead, you’ll file form 1024. Form 1024 is for you if you’re starting:

- A social welfare organization (501c4)

- A social club (501c7)

- A business league (501c6)

- A cemetery (501c13)

- A lodge or fraternal organization (501c8 or 501c10)

- Any other type of tax exempt organization that is not a 501c3

Keep in mind, the vast majority of nonprofits are 501c3s. The IRS charges $600 to file Form 1024. The IRS is currently taking 7-10 months to approve Form 1024, but you can always check their processing times here.

How to Start a Nonprofit in Kentucky Step 5: Additional Filings

The state of Kentucky will require you to register in order to fundraise, but thankfully, they do not charge a filing fee for the initial filing or your annual renewal. Registering to fundraise is called charitable solicitation registration (or CSR). Essentially, it’s permission to solicit (or ask) for donations from people who live in Kentucky. If you’ll be soliciting donations from people in other states, you’ll need to check out that state’s requirements for CSR. You’ll need to file a separate form if your fundraising activities include bingo or raffles.

Depending on the type of organization, you might want additional policies or agreements. For example, if you have volunteers, you’ll likely want a volunteer agreement in place. Or if you work with children, animals or any other vulnerable population, you’ll likely want solid safety policies in place. Churches also have their own considerations to take into account like statements of faith and facility use agreements. No matter the type of nonprofit you want to start, we are here to help. Our legal team is happy to guide you through how to start a nonprofit in Kentucky from start to finish. We’re happy to complete some (or all!) of the process for you. Reach out for a free initial consultation to learn more.

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025

- Legal Advice for Nonprofits: When to Get Help and What’s at Stake - October 15, 2025