If you’re ready to learn how to start a nonprofit in Massachusetts, keep reading to learn more from our legal team. We’ve helped start hundreds of nonprofit organizations successfully. In this article, we’ll walk you through the key steps to launch your nonprofit in the Bay State, from filing your incorporating document to achieving 501c3 status. This can be a bit of a complex process, so if you need help, don’t hesitate to reach out!

How to Start a Nonprofit in Massachusetts Step 1: Laying the Foundation

Before incorporating with your state and filing with the IRS, it’s important to establish a strong foundation. This involves defining your mission, forming a board of directors, and planning your funding sources. These three things are simple yet essential when you’re learning how to start a nonprofit in Massachusetts

Mission

Start by clarifying your mission. Think about who or what you aim to serve and how you plan to do it. A well-crafted mission statement can be as simple as a few sentences answering these key questions:

- Who or what are we serving?

- How will we serve them?

- What’s our ultimate goal?

Your mission statement should be straightforward and easy to understand, even for someone unfamiliar with your field. Look at similar organizations for inspiration. Most nonprofits have their mission statements available on their websites, which can be a great resource.

Keep it clear and concise. Avoid jargon that might confuse potential supporters or donors. The goal is to make your mission accessible and appealing to your audience of potential community partners and donors.

Board of Directors

One crucial step in how to start a nonprofit in Massachusetts is forming a board of directors. The state requires every nonprofit to have at least three board members, the majority of whom should not be related by blood or marriage. You can be on the board yourself, but you can’t fill it with exclusively family members. This is often called a conflict of interest, something we’ll cover later in this article.

You absolutely can have board members who live outside of Massachusetts. This is growing more and more common in our increasingly digital age. Some organizations allow out-of-state board members to join meetings virtually over video or phone. While your initial board doesn’t have to be perfect, it’s important to choose individuals who are passionate about your mission and have the time to help your nonprofit startup. Some board members will need to take on officer roles like Board Chair or Secretary. Although Massachusetts allows one person to hold multiple officer positions if your bylaws permit it, it’s generally better to have different people in different roles to ensure smooth operations if someone becomes unavailable.

Funding

Let’s talk about funding. Even if you’re starting small, there are always costs to consider. Here’s a basic outline of what to plan for:

- Program Essentials: What do you need to start your programs? Don’t forget materials and supplies for any events you want to hold.

- Staffing Needs: If you plan to hire staff, include wages, payroll tax and benefits in your budget.

- Office Supplies: Include costs for things like printing costs and computers for staff or volunteers.

- Startup Help: Consider costs for legal or administrative help.

- Online Presence: Investing in a website and branding can help spread your message.

- Fundraising Costs: Plan for any events or activities to raise funds.

- Professional Services: Budget for services like accounting if needed.

Understanding these costs will help you set a realistic budget and keep your nonprofit running smoothly from the start. This list isn’t exhaustive, but it gives you an idea of what to consider. Make sure you can cover the costs of the startup before you begin. Some nonprofit startups raise money from supporters for these costs, while others fund the startup themselves.

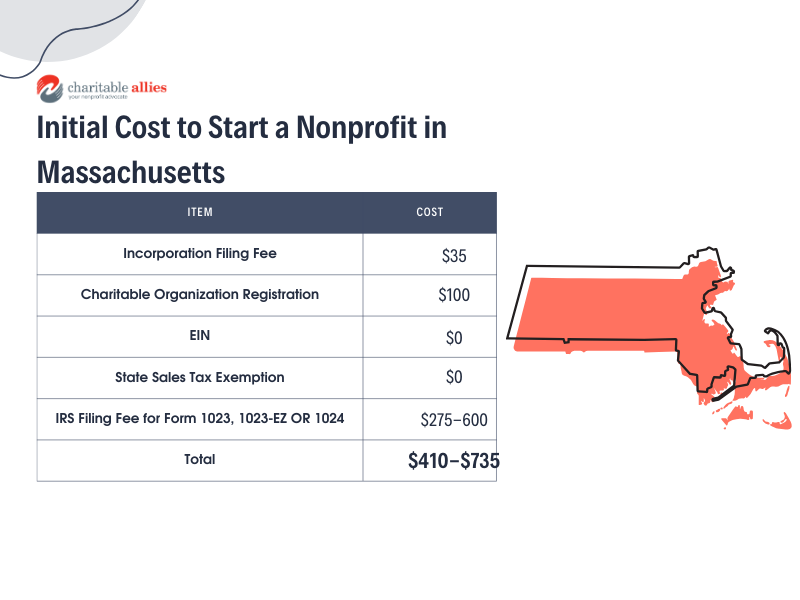

How Much Does it Cost to Start a Nonprofit in Massachusetts?

Before you start your nonprofit in Massachusetts here’s a quick summary of some of the costs you’ll want to look out for:

- Incorporation: Filing your Articles of Incorporation with the Massachusetts’ Secretary of Commonwealth will cost you $35.

- Charitable Solicitation Registration: For an initial fee of $100 you can register to solicit for donations. There are annual fees to watch out for. We give the list further into this article.

- EIN: Getting an Employer Identification Number (EIN) is free.

- Sales Tax Exemption: Applying for a sales tax exemption in Massachusetts doesn’t have a fee.

- IRS Tax-Exempt Status: Filing for 501c3 status with the IRS ranges from $275 to $600, depending on which application you complete.

With these costs tallied up you can expect to spend between $410 and $735 on the paperwork alone. If you’d like to save time and have someone handle the setup and guide you through the 501c3 process, feel free to get in touch! Our team would be happy to help.

How to Start a Nonprofit in Massachusetts Step 2: Incorporating in Massachusetts

To start a nonprofit in Massachusetts, you need to file Articles of Incorporation with the Massachusetts Secretary of the Commonwealth. Here’s what you need to know:

Filing Process

First, check if your chosen nonprofit name is available by visiting the Massachusetts Secretary of the Commonwealth’s website. You aren’t allowed to hold the same name as another organization so this is an important step to complete before you start filing any paperwork. You can file your Articles of Incorporation online, mail, or fax. We suggest filing online because it is the quickest and simplest option. The standard filing fee is $35 and this takes 5-7 business days. If you need expedited processing, you can pay an additional $25 and get your filings back in 2-3 business days.

Massachusetts does not require a specific suffix like “Inc.” for your nonprofit’s name, but you can include one if you prefer.

Required Information

When filling out the Articles of Incorporation, you’ll need to include information like:

- Nonprofit’s Name: Ensure your name is different from other organizations in Massachusetts.

- Purpose of the Corporation: A brief statement of the corporation’s purpose, often including a general clause allowing the corporation to engage in any lawful business.

- Nonprofits Address: Provide the main address where your nonprofit will operate. This cannot be a P.O. Box or the state will reject the filing.

- Registered Agent and Office: Name and address of the person in Massachusetts to handle any official mail for the organization.

- Incorporators: List those filling out the forms and starting the nonprofit, including their names and addresses.

- Directors: Include the names and addresses of your initial board members.

Step 3: Creating Bylaws and Other Key Documents

Often this is the part of the startup process most people tend to overlook. If you want to know how to start a nonprofit in Massachusetts the proper way, this step is crucial. We call it the “corporate documents” step and it encapsulates a few different documents. We’ll go through them one-by-one below.

EIN (Employer Identification Number)

Obtaining an EIN (sometimes called a tax ID) is crucial for tax purposes. This nine-digit number issued by the IRS is needed to open a bank account, hire staff, and apply for tax-exempt status. You can apply for an EIN online through the IRS website, and it’s free. Be sure to complete this step after your nonprofit is officially incorporated in Massachusetts.

Bylaws

Next, you’ll need to draft bylaws for your nonprofit. Bylaws are the rules that govern how your organization operates. They should cover how your board is run, how conflicts are resolved, and what happens if the nonprofit dissolves. Important elements include:

- Process for selecting and adding board members

- Procedures for removing board members

- The nonprofit’s fiscal year

- Membership details and rights, if applicable

Keep your bylaws clear and simple, avoiding overly specific language that could be hard to follow. They should provide a solid framework for your nonprofit’s operations.

Conflict of Interest Policy

A conflict of interest policy is key for keeping things transparent and fair. It should clearly explain what counts as a conflict of interest and set out steps for managing these situations. For example, if a board member’s family member is being considered as a potential new hire, that board member should step back from any decision-making related to that hire. This policy helps ensure that all decisions are made with the nonprofit’s best interests in mind.

OFAC Compliance Policy

If your nonprofit plans to work internationally, an OFAC Compliance Policy is necessary. This policy ensures compliance with U.S. regulations overseen by the Office of Foreign Assets Control (OFAC), especially important if you’re dealing with foreign transactions or international activities.

How to Start a Nonprofit in Massachusetts Step 4: Achieving 501c3 Status

If you want to know how to start a nonprofit in Massachusetts you’ll need to obtain tax-exempt status, so you need to file the appropriate form with the IRS. There are three options, each suited to different types of organizations: Form 1023, Form 1023-EZ and Form 1024.

Form 1023: The Detailed Option

Form 1023 is the most comprehensive and is required for certain types of organizations like churches, schools, and hospitals (regardless of their size). This is also for nonprofits expecting to exceed $50,000 in annual revenue as well as those who will have over $250,000 in assets within the first three years. The filing fee is $600, and processing typically takes 6 to 10 months.

Form 1023-EZ: The Streamlined Choice

Form 1023-EZ is a simpler, shorter form available for smaller nonprofits. It costs $275 and is usually processed within 1 to 2 months. This form is suitable if you expect to have less than $50,000 in annual revenue and under $250,000 in assets over the next three years. Churches, hospitals and schools are not eligible to file this form.

Form 1024: For “Non-c3” Nonprofits

Nonprofits that don’t fit into the 501c3 category, like social welfare organizations or business leagues, should file Form 1024. The filing fee is $600, and processing can take 7 to 10 months. This time can change depending on how busy the IRS is, so make sure to check the IRS website for predicted times.

If your application is approved, you’ll get a determination letter that verifies your nonprofit is tax exempt. Keep your determination letter safe. It’s essential for applying for state sales tax exemptions, getting grant funding and more.

Step 5: Additional Documents

Charitable Solicitation Registration

If you plan to solicit donations (fundraise) in Massachusetts, you must register with the Massachusetts Attorney General’s Office. Charitable Solicitation Registration is a registration that allows you to ask for donations in your state. The initial fee is $100, with an annual fee based on your nonprofit’s revenue. The annual renewal fees are listed here:

- Less than $100,000: $35

- $100,001–$250,000: $70

- $250,001–$500,000: $125

- $500,001–$1,000,000: $250

- $1,000,001–$10,000,000: $500

- $10,000,001–$100,000,000: $1,000

- $100,000,000+: $2,000

Sales Tax Exemption

To receive a sales tax exemption in Massachusetts, your organization must apply for and receive a Certificate of Exemption (Form ST-2) from the Massachusetts Department of Revenue.

To apply, you’ll need to submit Form ST-2, along with your IRS determination letter confirming your 501c3 status and other required documentation. Once approved, your organization can use the certificate to purchase items without paying sales tax. This filing is free to complete.

Additional Policies and Agreements

Depending on your nonprofit’s focus, you may need specific policies, such as:

- Volunteer Guidelines: Clearly outlining responsibilities and requirements for volunteers is key to keeping everything running smoothly. It helps make sure everyone knows what’s expected of them and what they need to do.

- Safety Procedures: Putting essential safety procedures in place is vitally important, especially when working with vulnerable groups. Clear safety guidelines and background checks can prevent expensive lawsuits and increase the safety of participants, staff and volunteers.

- Church-Specific Documents: For religious organizations, having a statement of faith and a facility use agreement is key to staying true to the organization’s values and managing the use of church property effectively. These documents help make sure that all activities and participants align with the church’s beliefs and standards.

With our experience in helping over 2000 nonprofits nationwide, our team would be happy to help you start a nonprofit in Massachusetts. If you’re ready to get started, reach out and schedule a free consultation today.

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025

- Legal Advice for Nonprofits: When to Get Help and What’s at Stake - October 15, 2025