If you want to know how to start a nonprofit in Ohio, you’ve come to the right place! Here at Charitable Allies, our attorneys have helped nearly a hundred nonprofit organizations start and gain 501c3 status in Ohio, including cities like Cincinnati and Columbus. We’ve outlined the steps your nonprofit needs to take to get a 501c3 status in Ohio. If you’d like us to do some or all of the paperwork for you, our legal team would be happy to help. Request a free consultation here.

How to start a nonprofit in Ohio Step 1: Preparation

Define your mission

Before you learn how to start a nonprofit in Ohio, you’ll need to have a defined mission statement. A nonprofit needs a mission statement because it outlines the organization’s purpose in clear terms that serves as a roadmap for all of its operations. It keeps everyone (donors, employees, and volunteers) engaged by working towards the same goals.

Creating a mission statement involves five simple steps:

-

- Determine Your Nonprofit’s Purpose: Explain what you’re trying to accomplish.

- Make Your Goals Clear: State your objectives, but do it in a way that can be measured so you know what success looks like.

- Have a clear group or area you’re serving: Whether you’re serving families below the poverty line or the habitat of an endangered species, define your charitable class.

- Keep It Brief: Keep it succinct, understandable, and memorable.

- Assess and Enhance: Seek input and continue refining until it strikes a chord with your board, staff and/or volunteers.

If you want examples, look on the websites of similar organizations. If you’re starting an animal shelter, for example, look at the mission statements of other animal shelters around the country. There isn’t a specific way your mission statement should be worded, but you should limit it to one sentence.

Recruiting Board Members

Every nonprofit is required to have a board of directors made up of at least three people. The founder(s) often serve on the initial board of directors. The board has a few responsibilities including making large decisions for the organization, whether you’re hiring your first staff member or buying a building. You’ll need some members of your board to also be officers, like the board chair (or president) and the secretary. Here are three things you need to know when choosing your first board members:

- Family members can be on the board but not everyone on your board can be related by blood or marriage. You’ll need to have enough people on the board to “outvote” the people who are related. For example, a married couple on a board will need at least 3 other people on their board if they both want to serve.

- Find people passionate about your cause. You’ll want everyone to be aligned about your mission.

- There’s plenty of ways to recruit board members! Whether it’s someone you find on social media, at your church, in your neighborhood or at a networking event, there are tons of ways to get connected with people who share your passion for your mission.

For more information on finding the right board members click here.

How to start a nonprofit in Ohio Step 2: Articles of Incorporation

Filing Articles of Incorporation with the Ohio Secretary of State is essential to legally forming your nonprofit. Before filing, you want to make sure that no other organization holds the same name you’d like to use for your nonprofit. You can check if any organizations hold your name here. Unlike other states, Ohio makes your naming process easy by giving you the option to add a suffix such as “Inc.” This isn’t mandatory and is completely up to you if you’d like to add this.

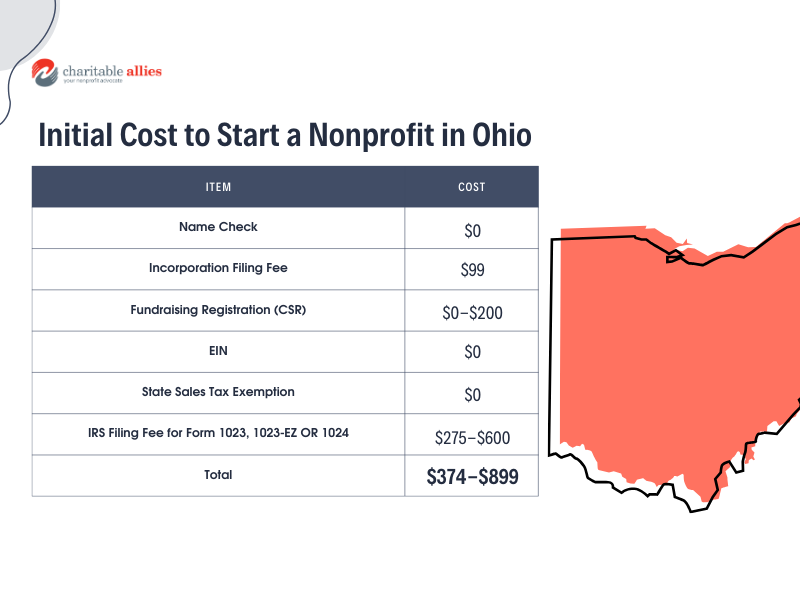

With this said, you will need to file Articles of Incorporation with the Ohio Secretary of State through mail or online. We suggest filing online due to varying times in shipping via mail. The filing fee Ohio charges is $99 with a processing time of 3-7 business days. If you need your Articles of Incorporation sooner, Ohio offers expedited fees starting at $100 for a 2 business day processing time, $200 for 1 business day processing time, and $300 for a 4 hour processing time.

The information in the Ohio Articles of Incorporation includes:

- The nonprofit’s name

- The purpose of the nonprofit

- The address of the nonprofit (People often use the address of a board member to start)

- The name and address of the incorporators (This is different from your board of directors; this is an individual or entity who forms the organization)

- A “statement of purpose” should clearly articulate your nonprofit’s charitable mission in language that aligns with IRS-recognized charitable activities. It is essential to be specific enough to demonstrate your activities are charitable while maintaining flexibility to allow for future program expansion.

How to start a nonprofit in Ohio Step 3: Bylaws and other Corporate Documents

Bylaws

Bylaws serve as legal guidelines for your organization.

Bylaws include rules about your board, the organization’s finances and more. Bylaws should be clear and specific enough that you know how to follow them, but not so specific that you’re locked into a heavily restricted format. Here’s an example: During the pandemic, many nonprofits had to change their bylaws because they required board meetings to be in person. This document is legally binding meaning that if you fail to meet the requirements in your bylaws you could be liable. You can read more about what’s included in nonprofit bylaws here. They need to be evaluated and updated in order to remain relevant every 2-10 years, depending on how much the nonprofit grows and changes.

Conflict of Interest

A conflict of interest policy is important for any nonprofit organization to ensure transparency, integrity, and accountability in its operations. By having a conflict of interest policy, your organization shows its commitment to doing fair and just work which helps gain trust among the public. This policy aims to identify potential unfair benefits among individuals associated with the organization, such as board members and employees. It also ensures disclosure and management of those conflicts to safeguard the nonprofit’s interests.

A conflict of interest occurs when a person in a position of authority within an organization could potentially benefit personally, either directly or indirectly, from decisions or actions made in their official capacity. An example of a potential conflict of interest is someone hiring a family member and being the sole person to determine their salary. These conflicts can hinder the individual’s ability to act in the best interests of the nonprofit, undermining its mission and credibility. A strong conflict of interest policy is crucial for maintaining the organization’s reputation, supporting public trust, and fulfilling its mission effectively.

EIN

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the IRS to organizations for tax identification purposes. An EIN allows your nonprofit to open a bank account, hire employees, and provide donors with the information they need when they donate to your cause. To get your EIN, complete the online application form with the IRS, providing details about the organization’s legal structure and purpose. After submitting the application electronically, you will receive an EIN for your nonprofit immediately. There is no filing fee to get your EIN, but you’ll want your nonprofit to be incorporated in your state already before you file for your EIN.

How to start a nonprofit in Ohio Step 4: Obtain Federal Tax-Exempt Status

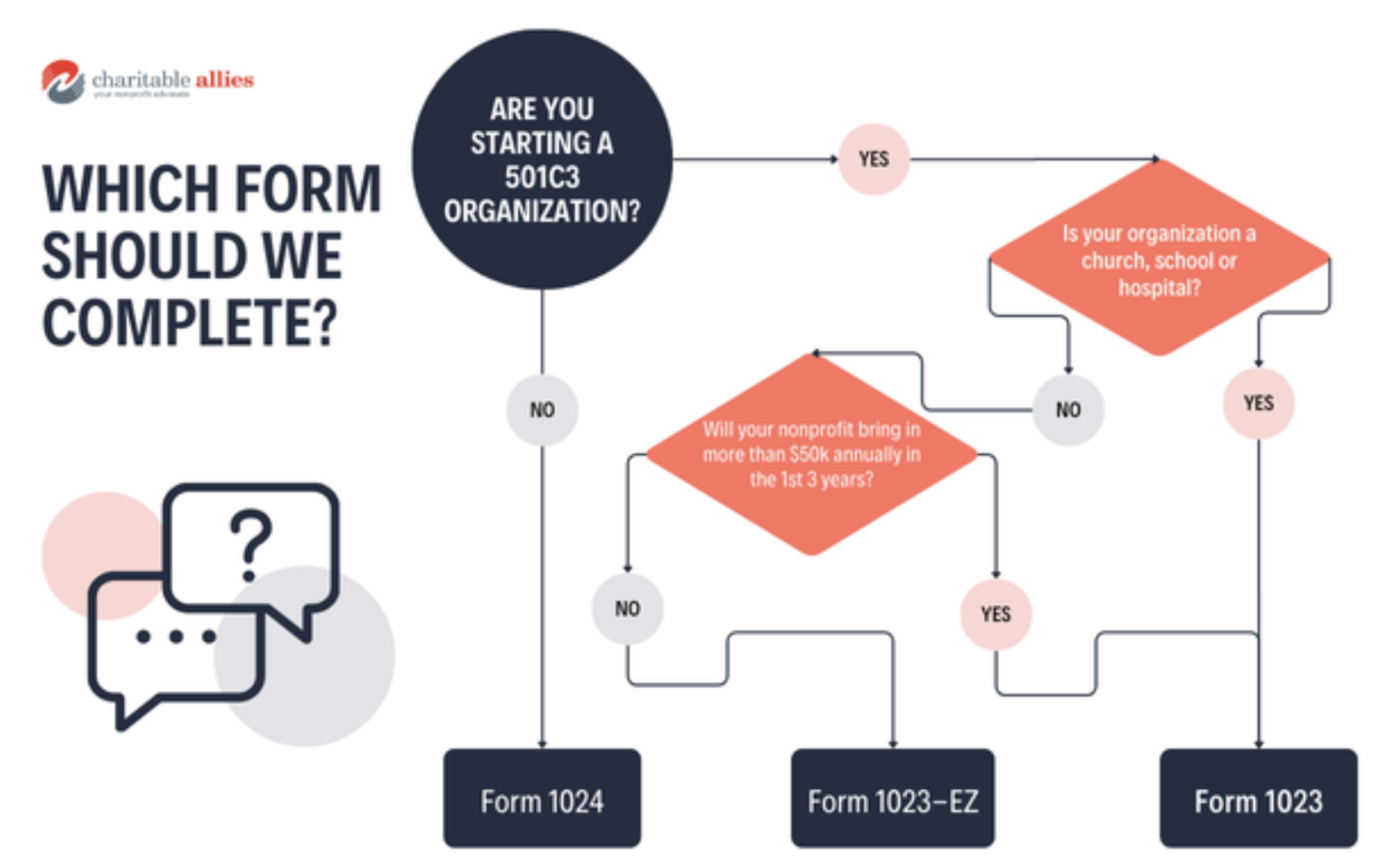

To be recognized as a tax-exempt organization in Ohio you must file Form 1023, 1023-EZ, or 1024 with the IRS. But which form is right for your organization? Use our flow chart above or continue reading to learn more about your options. Filing the wrong form with the IRS can cause it to be denied or cause issues down the road.

Form 1023

Form 1023 is used by larger nonprofit startups, nonprofits of certain types, or those expecting significant revenue. It is required for organizations anticipating more than $50,000 in annual revenue within the first three years or having assets over $250,000. Churches, schools and hospitals are also required to file Form 1023. The filing fee for Form 1023 is $600. Processing typically takes 6-10 months, but it can be longer depending on the IRS workload. This form is more comprehensive, requiring detailed information about the organization’s structure, operations, finances, and governance.

Form 1023-EZ

For smaller nonprofits, there is a simplified application called Form 1023-EZ. It is designed for nonprofits with assets of $250,000 or less and annual revenue expectations of $50,000 or less. Form 1023-EZ filing fees are $275. Processing can take anywhere from two to four weeks, on average. Compared to Form 1023, this form is shorter, more straightforward, and requires fewer specific details.

To find out if you are eligible for Form 1023-EZ, begin by evaluating your projected income, including donations and anything you might charge for your services. If you have donors, companies or grant providers who already want to fund you, take those funds into account. If each of your first three years falls under $50,000, and your nonprofit isn’t a church, school or hospital, it’s likely you’ll be allowed to do Form 1023-EZ.

If you’re not sure how much your nonprofit will bring in, that’s okay! The IRS asks you to make your best faith estimate. If you truly have no idea and don’t have a lot of initial funding lined up, you’ll probably be allowed to file the 1023-EZ. There are no penalties or differences in your tax exempt status if you file the 1023-EZ. If your organization does go over the $50,000 threshold unexpectedly, just make sure to report that on your 990. You won’t have to go back and file another Form 1023 if you surpass $50,000.

Once one of these forms have been approved you will receive your IRS determination letter which is a letter that proves your tax-exemption status! After receiving this letter your nonprofit is officially tax exempt!

If you’d like us to complete the 1023, 1023-EZ or 1024 for your organization, please get in touch! We’re happy to help.

Form 1024

Unlike Form 1023 and Form 1023-EZ, which specifically seek recognition as a 501c3 tax-exempt entity, Form 1024 is great for other types of tax-exempt organizations like social welfare organizations (501c4), labor agricultural organizations (501c5), and business leagues (501c6). Like Form 1023 and Form 1023-EZ, Form 1024 requires detailed information on your organization: its activities, governance structure, and financials. The filing fee for Form 1024 is $600. The approval times can expect to be around 7-10 months, the times can be found here.

How to start a nonprofit in Ohio Step 5: Additional Documents

Every state has different requirements needed for nonprofits. Here is a list of additional documents to consider when you are learning how to start a nonprofit in Ohio.

Fundraising Registration

Charitable Solicitation Registration is a fancy way of saying your state requires you to register in order to ask for donations. Any nonprofit organization intending to collect donations inside the state of Ohio must register for charitable solicitation registration. Before beginning fundraising you must register with the Ohio Attorney General’s Charitable Law Section within six months of doing so. Depending on how much in donations you receive you may have to pay fees for those contributions; $0 for contributions under $5,000, $50 for $5,000–$25,000, $100 for $25,000–$50,000, and $200 for $50,000 or more. You will be charged these fees in the fifth month following the close of the fiscal year. For example, if your nonprofits fiscal year ends on Dec. 31, the fee is due on the 15th of May. Online registration is available, and the processing time is normally one week.

If the IRS determination letter has not yet been received, nonprofits can begin the registration process while they wait for it by filing an Affirmation of IRS Status Form. As a result, the organization can start fundraising efforts right away and meet all state criteria. Visit the Ohio Attorney General’s Charitable Registration website for further details and to begin the registration process.

Sales Tax Exemption

Nonprofits must fill out the “Application for Sales Tax Exemption” form, often known as the ST-EX, in order to be eligible for an Ohio sales tax exemption. To be able for organizations to qualify as eligible for sales tax exemption, this form is necessary to make sure that all of their operations comply with state regulations.

Additional Policies and Agreements

Depending on the nature of your organization, you may need additional policies or agreements:

- Volunteer Agreement: By outlining roles, duties, and expectations in a volunteer agreement, confusion can be avoided and smooth operations can be ensured. Volunteers hurt while on duty might file a lawsuit without it.

- Policies for Safety: A well-defined safety policy is crucial for any organization that deals with children, animals, or other vulnerable groups. Background checks are an essential piece of this policy. In the event of an accident or incident, a safety policy reduces nonprofit’s liability and safeguards people from harm.

- Church-Specific Documents: Churches often have a statement of faith, which is sometimes included in your initial starting documents. If you have a building, you might want a facility use agreement to control the use of church property in a manner consistent with their beliefs and practices.

No matter what type of nonprofit organization you want to start, our legal team is here to assist you through the entire process of starting a nonprofit in Ohio. In our decade of experience, we’ve helped start hundreds of nonprofits nationwide, including nearly 100 in Ohio, ranging from Cincinnati to Toledo.

- Nonprofit Inurement, Private Benefit, and Conflict of Interest: What Boards Need to Know - February 24, 2026

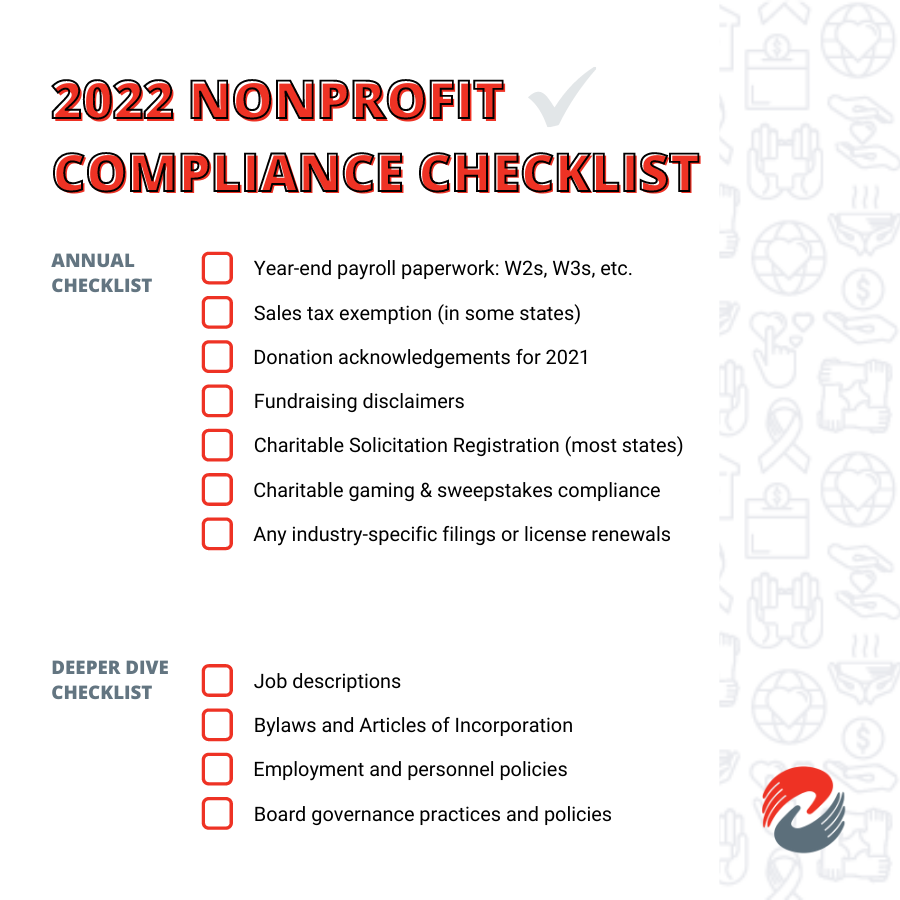

- What’s on Your Nonprofit Compliance Checklist? Here’s How to Keep It Manageable for IRS and State Requirements. - February 24, 2026

- Nonprofit Board Fiduciary Duties: What Every Director Should Know - February 24, 2026