If you get a notice from the IRS that your nonprofit status has been revoked, your 501(c)(3) status is no longer active. This can prevent you from applying for grant funding, obtaining gifts from companies, and securing funding from donors. Nonprofits lose tax exempt status automatically after 3 consecutive years of not filing their annual return on time (also known as the 990). From the middle of 2010 to the end of 2017, the IRS revoked the tax-exempt recognition of more than 760,000 nonprofit organizations for that reason. So if you’re looking to reinstate 501c3 status for your nonprofit, you’re not alone. If you’d like assistance through the process of nonprofit reinstatement, our legal team helps hundreds of nonprofits get 501c3 status back every year. Reach out to us for a free initial consultation where we can talk with you about the best options and cost for your unique situation.

How do I know if my 501c3 status was revoked?

Typically, you’ll get a letter from the IRS. But those letters are notoriously slow to arrive, sometimes not arriving to the registered address until a few months after the organization has its 501c3 status revoked.

Not sure if your 501c3 status was revoked? You can always search for your nonprofit’s EIN or name on the IRS tax exempt organization search. If your organization’s 501c3 status was revoked, it’ll have a badge that says “auto revocation list” next to your organization’s name when the search results appear. So what’s the process for how to reinstate 501c3 (or other tax exempt) status? We’ll walk you through your options and the process briefly below. But if you’d like a nonprofit attorney to handle the nonprofit reinstatement process for you, please let us know. We’re happy to assist.

So how do you get 501c3 status back? What is nonprofit reinstatement?

To regain 501(c)(3) status, you’ll go through nonprofit reinstatement. Nonprofit reinstatement is the process by which you can get 501c3 status back from the IRS to ensure your nonprofit is once again in good standing. This process refers to being in good standing with the IRS specifically. If you’ve had your nonprofit’s 501c3 status revoked, you should also check with your state to see if your nonprofit was dissolved at the state level if you haven’t kept up with any state paperwork. Each state has its own process for putting your nonprofit back into compliant status, so in this article, we’ll focus on IRS reinstatement.

There are different types of nonprofit reinstatement, which we’ll break down below. No matter which type of nonprofit reinstatement you’d like to pursue, our legal team is happy to help with any of the options and with identifying which option could be right for your unique circumstance. Request a consultation with a member of our legal team to learn more.

Types of Nonprofit Reinstatement

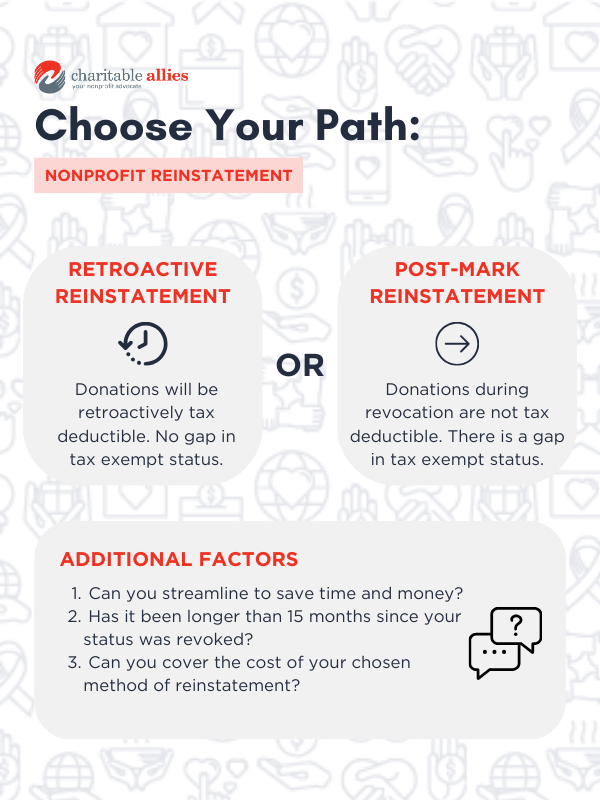

Retroactive vs Post-Mark Reinstatement

The first choice you’ll need to make when deciding how to reinstate 501c3 status is between retroactive and post-mark. At the most basic level, retroactive reinstatement allows your organization to be tax exempt retroactively the entire time you were revoked. Post-mark reinstatement, on the other hand, will show a gap in your 501c3 status. Retroactive reinstatement is the most popular option for two primary reasons:

- With retroactive reinstatement, your nonprofit will not have any gaps in tax exempt status. This means that if someone, say a grant provider, looks to verify your 501c3 status with the IRS, it will show that your nonprofit has been tax exempt the entire time. As long as your retroactive reinstatement is approved by the IRS, they will give you retroactive tax exempt status, meaning even during the time you were revoked, your nonprofit was still tax exempt.

- The second reason is donors. Any donations made to your nonprofit while your status was revoked will still count as tax deductible for donors if you regain your 501c3 status through retroactive reinstatement.

In contrast, post-mark reinstatement means donations made during the time you were revoked are not tax deductible. Only donations you receive moving forward after reinstatement would be tax-deductible. And there is the risk that donations made while you were revoked could actually be taxable income and the IRS could request taxes on any funds brought in during that time. It would be an uncommon situation, but it is a risk.

With retroactive reinstatement, be aware that you’ll also need what’s called a Reasonable Cause Statement, which is a written statement that provides the IRS explanation as to why you were unable to file the annual return at least one of those years.

The last key difference is that for retroactive reinstatement, you will need access to the financial information from the unfiled or late years your nonprofit didn’t file your 990 on time. You’ll have to backfile those documents during the process. If your nonprofit has experienced a significant amount of change in leadership or doesn’t have access to your financial records for any other reason, post-mark reinstatement might be the right option because it requires less financial information.

How to Reinstate 501c3 Status Faster: Streamlined Option

If your organization files the 990-N or the 990-EZ, you could be eligible for a faster option called streamlined reinstatement. The streamlined version is a faster, less expensive way to reinstate 501c3 (or other tax exempt) status.

If your organization files the 990-N or the 990-EZ and this is the first time your tax exempt status has been revoked, you’re likely eligible for either streamlined retroactive or post-mark reinstatement. If this is not the first time your nonprofit status has been revoked, but you file the 990-N or 990-EZ, you’re not eligible for streamlined retroactive reinstatement, but you can still do streamlined post-mark reinstatement. If your nonprofit files the full 990, you are not eligible for the streamlined option according to IRS standards.

The streamlined option will take your filing fee down from $600 to $275 with the IRS. It will also speed up the timeline. Typically, reinstatements that are not streamlined can take the IRS 6-10 months to review and approve. Streamlined reinstatements usually take the IRS closer to 1-3 months to review and approve.

How to Reinstate 501c3 Status After 15+ Months of Revocation

If your nonprofit’s 501(c)(3) (or other 501(c) status) was revoked more than 15 months ago, there are added steps the IRS requires if you want to file for retroactive reinstatement. If you would like to do post-mark reinstatement, the process does not change.

For example, you’ll have to give a reasonable cause statement for why the 990 wasn’t filed for all three years it wasn’t filed. If you don’t have reasonable cause for why you weren’t able to file the appropriate 990 for those years, you’ll need to file for post-mark reinstatement. Because there isn’t a set of exact standards for what counts as a reasonable cause, it can be helpful to have someone familiar with the nonprofit reinstatement process involved. If you’d like assistance with the process, reach out! Our legal team has helped hundreds of nonprofits reinstate 501c3 status nationwide.

How much does it cost to reinstate 501c3 status?

The cost depends on a few factors. The two primary factors are:

- Which 990 form your nonprofit files

If your nonprofit files the 990-N or the 990-EZ, the IRS filing fee will likely be less than if your nonprofit files the full 990 form. Often, you’ll have to pay the same filing fee from when you originally gained tax exempt status (either $275 for the 1023-EZ or $600 for the 1023 or 1024).

2. Which type of nonprofit reinstatement you choose

Typically, post-mark reinstatement is a slightly lower cost than retroactive reinstatement because it does not involve backfilling the missing 990s unless your nonprofit is small enough to qualify for the 990-N.

It can be a difficult and lengthy process for newcomers to reinstate the status of their nonprofit organization, but with the help of a knowledgeable nonprofit attorney, the process doesn’t have to be daunting! Reach out to us for a free consultation to speak about which kind of reinstatement could be right for your nonprofit organization.