The simple answer is yes; you can convert a private foundation to a public charity. Whether you accidentally checked the wrong box on your IRS Form or your mission has changed, there’s a simple fix. Today, let’s talk about Form 8940, along with the proper process. If you’d like someone to handle the process for you, our team of nonprofit attorneys has been through the process numerous times. If you’d like to connect with a member of our legal team, reach out to schedule a consultation. Otherwise, keep reading to learn more about the legal process of converting a private foundation into a public charity.

Where Do I Start to Convert a Private Foundation to a Public Charity?

Before you dive in, make sure your organization will pass the public support test. The public support test is what the IRS uses to figure out which organizations qualify as a public charity. If your nonprofit doesn’t pass one of their two tests, you won’t be able to convert it.

The test most public charities pass is called the 509(a)(1) public support test. If you receive most of your funding from donations, this is the test for you. Basically, you’ll need to be able to show the IRS that at least one-third (or 33%) of your revenue comes from donations from the general public. If you’d like to calculate if your nonprofit would pass this test, check out the full article on it here.

When your revenue comes primarily from program service revenue (or fee-for-service), you’re more likely to pass the 509(a)(2) public support test. In this version of the test, combine the amount of money you bring in by charging fees for your charitable services (including government fee-for-service contracts, adoption fees, etc.) with the donations you get from the general public. Is that number 33% or more than your total revenue? If the answer is yes, you pass the test.

However, certain organizations are known to benefit the public. This includes churches, schools, hospitals, and other similar organizations. These organizations don’t have to meet the financial requirements of the public support test. But they do have other requirements within the Schedule A that prove their status.

What if my Nonprofit Doesn’t Pass the Public Support Test?

Not passing the public support test simply means your organization cannot be a public charity. If you’re a private foundation converting to a public charity, you have to show you pass the support test; if you can’t, then you cannot convert and would have to remain a private foundation. The IRS understands that sometimes things happen, and your level of public support doesn’t meet the requirement in one year. This is why the IRS does not reclassify a public charity into a private foundation until after two years of not meeting the requirements of the public support test. Meaning if you fail the public support test in year 1 but pass in year 2, your status is safe. If not, then it’s converted to a private foundation, which has different requirements. For more information on the difference between a private foundation and a public charity, check out the full article here.

How Do I Tell the IRS I Want to be a Public Charity Instead of a Private Foundation?

First, file a Form 8940. This form is called a Request for Miscellaneous Determination, which tells the IRS you want to be a public charity and not a private foundation. You’ll fill this form out twice; once at the start of the process and then again 60 months later. 60 months (5 years) might feel like a random amount of time, but it’s the IRS rule. When you file this form, it kicks off the 60-month transition period where you’ll act like a public charity while still being technically classified as a private foundation.

Why Does it Take So Long To Convert a Private Foundation into a Public Charity?

Five years is a lot of time to correct a simple mistake, and it’s definitely frustrating to hear that it’s going to take that long. But it’s helpful to understand why. Think of a public charity as a step up from a private foundation, like a promotion. A promotion means more work and more time dedicated to showing the boss (the IRS) that you’re committed and ready to do the work it takes to get your new position. So the IRS is testing you for the promotion. They want to see 5 years of public support to calculate the public support test and prove that you are a public charity and deserve the promotion.

What do I do during the 60 Month Period?

The simple answer? File your Form 990-PF on time annually. Why? Technically, your nonprofit is still a private foundation in the eyes of the IRS during the waiting period. However, once you’ve started the 60-month transition, you should check the box on page one that tells the IRS you’re in the process of terminating your private foundation status. Filing the form late or incorrectly can cause problems in the transition or it could even cause you to lose your 501c3 status entirely.

What Happens after the 5 Year Period?

Now that you’ve spent the last 5 years acting like a public charity, your final step is filing the Form 8940 for the second time to request the final conversion of your status from private foundation to public charity. Unlike the first time you filed the Form, this time you’ll have to include the appropriate Form 990 for public charities, and a Schedule A calculating the public support test to prove to the IRS that you’ve reached your goal.

The Form 990 you file will not be the 990-PF; this time, you have to file the form for your public charity. There are three types of Form 990s that only public charities file, depending on your financial activity. If you’re a small organization with less than $50,000 of receipts (meaning the total amount of money coming in without subtracting costs and expenses), you’ll file the Form 990-N, which is the quickest form. Form 990-N is an online filing with the IRS that is simple enough for most people to take care of without an accountant. A mid-sized organization ranging between $50,000 and $200,000 files a 990-EZ. Some nonprofits at the 990EZ level find it helpful to have a bookkeeper or accountant helping them. The longest form is for organizations with receipts greater than $200,000 and total assets greater than $500,000. This form is simply called the 990. If you’re filing a 990, especially the year after converting from a private foundation to a public charity, you’re going to want an accountant’s help to get it right. Form 990 is a highly detailed filing with the IRS.

And finally, Schedule A tells the IRS the information they need to “promote” you to a public charity. File these three things at the end of the 60-month process, and you’ve successfully converted from a private foundation to a public charity.

What if I Just Made a Mistake and I’ve Always Should have been a Public Charity?

Accidents happen, and the IRS doesn’t penalize you for it. If you have always passed the public support test and should have been since the beginning, then when filing the Form 8940, check the box that tells the IRS it was a mistake. When you do, you will also have to provide proof that you should be a public charity by submitting a Form 990 and Schedule A as applicable. This means you won’t have to go through the 60-month process. Typically, filing Form 8940 takes a few months, but it’s still a shorter time than the 60 month waiting period. This option is more successful with organizations that have recently gotten their determination letter, and realized there was a mistake in their classification before their first 990 was due.

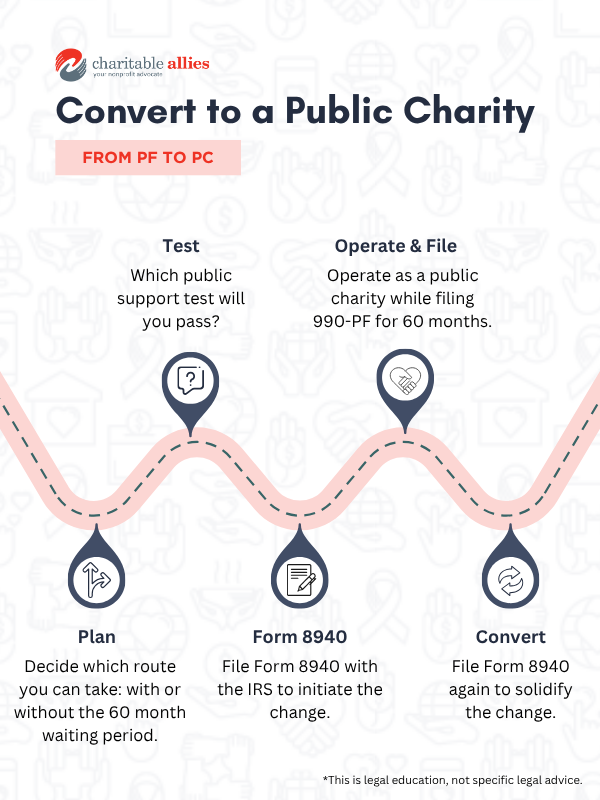

The Process of Converting a Private Foundation into a Public Charity Overview

- Figure out which public support test you’ll pass.

- File Form 8940 to tell the IRS you are changing a private foundation into a public charity.

- For the next 60 months, act like a public charity by collecting donations and/or gathering fee-for-service revenue to show the IRS you are a public charity. In these 60 months, you’ll fill out the 990-PF like normal but check the box that says you’re ending your private foundation status.

- File another Form 8940 with another Form 990 that is appropriate for your new public charity (Form 990, 990-N, 990-EZ).

Alternative Option

You could also dissolve the private foundation and start a new public charity instead of using the 5-year process. This may only take two or three years instead of five, but keep in mind that faster also means more expensive and more work. You would be starting over with a new organization. You’d create a new board of directors, new fundraising registration and basically starting from scratch. You’d also have to tell the IRS that you’re creating a successor organization. Keep in mind: successor organizations, regardless of their annual revenue, are required to file Form 1023 to get 501c3 status. They are not eligible for Form 1023-EZ. If money isn’t a problem and you’re willing to put in the extra work, this could be the option for you, but it may be easier to follow the 60-month plan.

Need Support?

Mistakes happen, but a simple mistake like marking the wrong box on Form 1023 is not the end of the world. Charitable Allies is here to help you understand the process and help you navigate the (sometimes confusing) rules of the IRS to convert from a private foundation to a public charity. Reach out to us for a free consultation with an experienced nonprofit attorney, and we can help guide you through the process.

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025

- Legal Advice for Nonprofits: When to Get Help and What’s at Stake - October 15, 2025