Most people don’t read through the terms and conditions when they make a new account. But the terms and conditions in the contracts you send and sign for your nonprofit can actually be life-savers or expensive headaches in the making. Let’s talk about contracts for nonprofits: what your nonprofit should have in place, what to look for, and how a great contract can help your nonprofit run smoother.

Why would a nonprofit need a contract?

A well-written contract can:

- Communicate expectations clearly with funders, vendors, directors and/or nonprofit partners to ensure everyone is on the same page

- Reduce the risk of safety issues, lawsuits, conflicts with funders, and other expensive issues

- Protect your nonprofit from being taken advantage of

- Protect your nonprofit’s money if there is money involved in a transaction with another organization

- Ensure your programs can run smoothly

- Keep entities you’re working with accountable so you can rely on people to do what they say they will do

- Assist new people being hired, volunteering, etc. with your organization in understanding your nonprofit’s relationship to other individuals or organizations during the onboarding process

Put simply, a good contract can save your nonprofit the time, money, and hassle of dealing with bigger problems in the long run. If you knew something could help your professional relationships and help you avoid lawsuits, why wouldn’t you do it?

Does the contract need to be in writing?

It’s not required, but it’s highly recommended that your contracts are in writing. Having a written contract spells out the terms clearly for everyone involved and protects your nonprofit from risk. Lawsuits over verbal agreements are plentiful and expensive.

The “he said, she said” of verbal agreements can be significantly more difficult, time-consuming and expensive to deal with if something goes wrong. It might seem easier to just shake hands on it, but don’t. The extra few minutes spent creating and signing a contract up front can save your nonprofit thousands in the long run. It also helps make things official and puts the terms of the relationship clearly in writing so everyone is on the same page. Remember: clear is kind.

When is it time to put a contract in place?

If you’re wondering when it’s time to get a contract created and signed, the answer is usually as soon as possible. Events that usually need a contract include:

- Establishing a new relationship with a vendor or contractor, including buying or renting goods or services

- Entering into a new grant

- Creating a partnership, joint venture, or other collaboration with another nonprofit

- Opening new locations of an existing nonprofit or creating an affiliate model

- Hosting an event on property not owned by the nonprofit

- Accepting fee-for-service for specific goods or services your nonprofit will provide

- Adding a new volunteer to a team, especially one who will volunteer more than once or with a vulnerable population

- Selling a large asset like a vehicle or building

Typically if your nonprofit is agreeing to do something, not do something, partner up to accomplish a goal, or you’re having another party do any of these things for your organization, it’s probably time to put a written contract in place. Even if you know the other party personally, put a contract in writing and have all parties sign it. Prepare for the worst case scenario. If everyone involved didn’t like each other, what provisions and protection would you want to have in place?

Having a contract in writing also keeps things clear and professional, and gives insight into the arrangement for your board, potential funders, or anyone else who might ask. Use the bus test: if you were to get hit by a bus tomorrow, would the person filling in for you know what your relationship was with your vendors, partners and funders from the contracts alone? The answer should be a resounding yes.

So what kind of contracts should a nonprofit have in place?

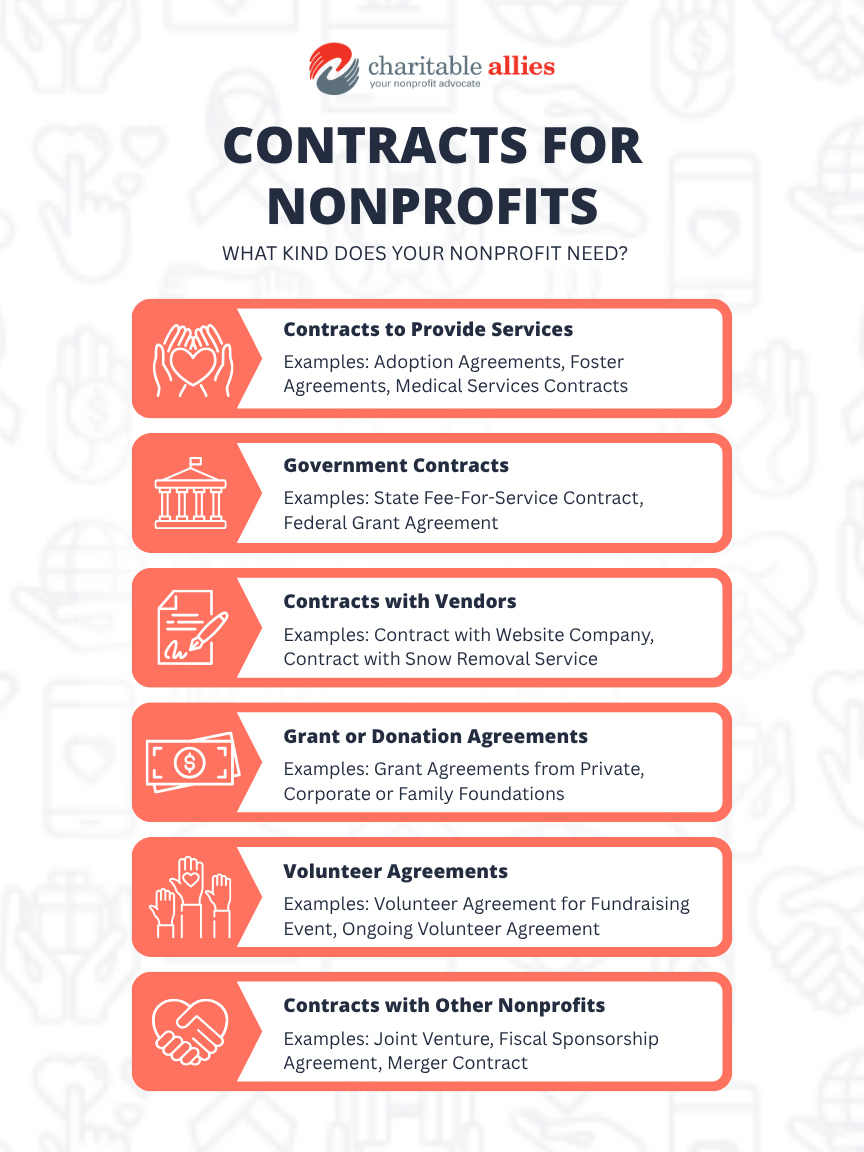

Nonprofits often have contracts with volunteers, clients, providers, event vendors, funders, other nonprofits, government entities, vendors, governing bodies like denominations or national headquarters or even affiliates. Point being, It depends on the type of nonprofit you’re running. Below, we dive in to a few common contracts nonprofits need, but if you’d like a nonprofit lawyer to analyze your needs and draft contracts specific to your program and state law, let us know.

Service Contracts for Nonprofits

For nonprofits providing direct services, you might want an agreement that establishes what you’re providing, to whom, what the costs are (if any) to the one you’re serving, and what the terms are. We’ll use a common example to illustrate the point.

Organizations that provide foster and/or adoption services for pets need to have an agreement in place with the family fostering or adopting. Ideally, a foster contract would discuss the terms including the standards foster families must meet to continue to foster, as well as the support services your nonprofit will provide, which could include money, education on animal training, crisis handling or behavior, a member of your staff who visits occasionally, etc. In all contracts, you should have set terms and what happens if the other person or company doesn’t stick with them (also called a breach). In this example, someone adopts a dog from your rescue, but you learn they’ve been mistreating the animal, leaving him outside for hours in the hot sun all summer. If your adoption contract doesn’t include information on the terms of the adoption, it will be significantly more difficult to get the dog out of that home and into a safe environment.

Indemnification is compensation (usually financial) for harm or loss. In this example, think about what happens if a dog adopted from your shelter bites someone. Is your nonprofit liable to pay their medical bills? A contract with a good indemnification clause can protect your nonprofit from being on the hook for costs if something goes wrong.

Contracts protect nonprofits both financially and programmatically. Let’s say your nonprofit produces an educational curriculum. A great contract can protect your nonprofit’s intellectual property and help others use it by the terms you set. So for example, if a school wanted to use your curriculum, you could set the proper ways it could be used and ensure they properly pay your nonprofit for using it. This way, you can be sure your curriculum is delivered in a consistent way and that no one is passing it off as their own.

Think through the services you provide to consider what contracts make sense for your programs. This looks different depending on the type of nonprofit. If you have specific questions on what kind of contracts your nonprofit needs, please reach out to an experienced nonprofit attorney for help.

Government Contracts for Nonprofits

About 30% of nonprofits receive grant funding from the government according to Guidestar’s 2022 and 2023 data. Government grants, whether they’re federal, state, or local, will include some sort of contract or grant agreement. Often, these are either straightforward grant agreements or they’re fee-for-service agreements.

Grant Agreements

A grant agreement usually spells out how much funding is involved, along with what services the grant provider (the government in this case) expects your nonprofit to provide with the funds. They’ll also include reporting information like what data they’d like from your organization in the grant report and what the deadlines are for reporting. Government grants, especially federal ones, are notorious for having intense grant reporting requirements. Plan for hours of gathering data and reporting it back to your funder if you have a government grant. Some nonprofits have to hire part-time or full time staff members to keep up with the requirements of government funders.

Fee-For-Service Contracts

On the other hand, fee-for-service (or program service revenue) is a model that allows nonprofits to be paid for the charitable services they provide. In these arrangements, a funder or a government entity (like your state or county) will enter into a contract with the nonprofit, agreeing to pay a certain price for services you provide the community. For example, in some states, the state government will provide funding to nonprofits that provide child abuse prevention services. If your nonprofit entered into one of these contracts, you’d need to know:

- What service(s) the contract will cover, especially if you provide more than one service

- How much the nonprofit will get per person served

- If your organization will need to front the cost (a reimbursement model)

- What the payment schedule will be

- What information the funder will need from you in order to provide payment

- How long the contract will run

- When (or if) pricing or terms will be re-negotiated (often there’s a set number of months or years)

Typically, your nonprofit won’t have a ton of negotiating power with the federal government contracts, but you can often negotiate more favorable terms with state or local officials, depending on the contract.

Vendor Contracts for Nonprofits

If you are providing money to someone for a good or service, especially if it’s a large amount of money or it’s an ongoing project, put a contract in place. Many vendors will have their own pre-made contract for you to review. Here are some beginner tips on what to look out for in a contract with a vendor:

What is included and what is not included?

This is often called the “scope of work” in a contract. Check this section to make sure you’re on the same page with the vendor about what’s included and what isn’t. For example, if you have someone creating a website for your nonprofit, will they include ongoing tech support if something breaks? Or will they do a round of edits if you catch mistakes on the new website? Who will keep the website plugins up-to-date? The scope of work should answer questions like this.

What are the cancellation terms?

If you’re entering an ongoing contract, like a service you pay monthly for, like Zoom or an exterminator, you need to know how to cancel. How many days notice do you need to give the vendor before you’re allowed to cancel? Often, people will try to cancel a subscription or an ongoing bill right before it’s due, but by then, it’s often too late. Most contracts require at least 30 days notice before you can hop out.

What happens if something goes wrong?

This is a very important question, especially for events. If you’re throwing a golf outing fundraiser and it storms the day of the event, will the venue let you reschedule for free? Will your organization get your money back if the event is cancelled due to a global pandemic? These are the kinds of questions a good nonprofit attorney can answer for you by reviewing and negotiating your contract before you sign it.

Other Contracts Nonprofits Might Need

In addition to vendor contracts and service contracts, there are a host of additional contracts a nonprofit might need. Most commonly, we see nonprofits needing four more contracts:

1. Contracts with volunteers

More than 75 million people volunteered last year according to AmeriCorps. A volunteer agreement can help you establish volunteer roles, safety standards, and more. If you have volunteers who work with vulnerable populations like the elderly, people with disabilities, children, or animals, you’ll likely want a good volunteer agreement and a set of safety standards in place.

2. Grant agreements with private funders

Like the government grant agreements, many private grant providers will have you sign a grant agreement before sending funds to your nonprofit. The grant agreement should spell out how much funding is involved, along with what services the grant provider expects your nonprofit to provide with the funds. They’ll also include reporting information like what data they’d like from your organization in the grant report and what the deadlines are for reporting. Not following a grant agreement can cause huge issues, including having to give the funds back to the grant provider. If your organization provides grants or scholarships to others, get a solid agreement in place and have a nonprofit attorney look over it to ensure you have the proper terms in place to protect your organization from liability.

3. Contracts with other nonprofit organizations

If your nonprofit provides services with another nonprofit, shares back office functions, or enters into a grant with another nonprofit, you’ll need a contract in place to establish the terms of the relationship. A contract can create a variety of types of relationships between nonprofits like a joint venture, all the way up to a full-blown merger. Check with your nonprofit lawyer to see what type of legal relationship is best for the specific circumstances of your situation.

4. Facilities Use Agreements

If your nonprofit owns a building or another large asset like a vehicle, you can rent out your space to others to generate revenue, but be sure to have a facilities use agreement in place. This is common for organizations like churches or museums that have beautiful buildings people might want to rent out for events like weddings or birthdays. A facilities use contract can establish how the people renting your property can use it, along with what they’re not allowed to do.

Conclusion

Nonprofits often use and need more contracts than they realize. Even the Terms and Conditions on your website are a form of contract. Some organizations also have Donor Terms or Donation Agreements, to ensure donations can be used properly, honoring what the donor wants, while also being realistic to what the nonprofit needs.

No matter what kind of nonprofit you run, odds are, you’ll need a contract in place for at least one of your relationships with a funder, vendor, or other party. If you’re entering into a new contract or need to establish one, reach out to us. We’ve helped hundreds of nonprofits nationwide to create contracts that help them prevent risk, while still being able to achieve their goals.

- Unrelated Business Taxable Income: What Nonprofits Need to Know for 2026 Filing - January 16, 2026

- 501c3 vs. 501c4: What’s the Legal Difference and Which Fits Your Mission? - December 16, 2025

- 501(c)(3) Lobbying Limits: What Nonprofits Need to Know Before Advocating - December 5, 2025