How to Start a Church: Getting 501c3 Status and More!

Churches and Religious Organizations

a nonprofit law firm that exclusively serves nonprofit organizations because we believe all nonprofits should have access to great legal counsel that doesn’t cost a fortune. Whether you’re starting a nonprofit, reorganizing, or solving board conflict, our nonprofit lawyers will provide the guidance you need to get back to what matters most: your mission.

We’ve heard from hundreds of nonprofit leaders who’ve struggled to find a nonprofit lawyer who understands the unique rules, regulations, and needs of a nonprofit organization. Most attorneys aren’t trained in nonprofit-specific laws, and the few that are often charge more than charity organizations can truly afford.

In 2013, we noticed nonprofits often struggled with overwhelming legal requirements and complexities, but had few places to turn. More than that, the lawyers who did offer services often charged double or triple what most nonprofits could afford.

Our attorneys set out to change that. Charitable Allies, a nonprofit legal aid law firm, was created in 2013 by nonprofit professionals and lawyers who wanted to fill the gap. Charitable Allies focuses exclusively on serving and supporting nonprofits and their stakeholders. As a nonprofit organization ourselves, we understand the unique challenges that nonprofit organizations face.

We provide legal support and education at “low-bono” (or below half fair market value) rates for nonprofit clients around the country. We also provide free educational resources for nonprofit leaders on our blog and newsletter. Whether a new animal shelter is looking to get their 501c3 status or a youth sports club is looking to set safety policies, we are here to help.

Since opening our doors, our nonprofit lawyers have helped over 1000 nonprofits nationwide with legal challenges of all shapes and sizes. We know that when nonprofits thrive, they can change the world for the better.

Schedule a consult with our legal team! We’re here to help you achieve your mission.

When nonprofits have the right resources, communities thrive, and the world is a better place. At Charitable Allies, we’re a lean, dedicated group that works hard but still knows how to have fun. If you’re interested in joining our growing team, check out our career opportunities!

Churches and Religious Organizations

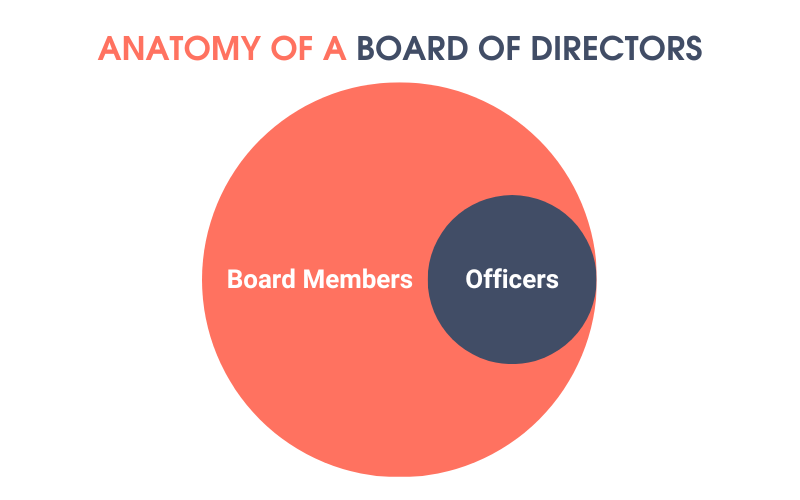

Board and Governance