Wondering how to start a nonprofit in Texas? Our legal team at Charitable Allies has helped hundreds of nonprofits get 501c3 status nationwide. No matter what city, from Houston to El Paso, this post outlines the crucial steps your organization needs to take to successfully start your nonprofit in Texas. Request a free consultation by completing this form.

How to Start a Nonprofit in Texas Step 1: Laying a Foundation

Before you learn how to start a nonprofit in Texas, there are a few things to prepare. Here are 3 key factors to think about before you start the charity or foundation:

- Mission: What’s your cause?

- People: Who is passionate about your mission and going to help the nonprofit thrive?

- Funding: How much money will you need to start out?

Mission

Before you start a nonprofit in Texas, you need to know what your mission is. You’ll need to know who or what you’ll be serving. It can be helpful to create a mission statement that outlines:

- Who or what will we serve?

- How will we serve?

- What is our end goal?

Mission statements usually aren’t long– a sentence or two. But they should make it clear what the aim of your nonprofit will be. To find examples of what your mission statement could look like, look up similar organizations in different geographic areas. Most nonprofits have their mission clearly stated on their website, so it can be helpful to see examples in your line of work. No matter what you choose to do, make sure anyone who reads your mission statement will understand what your goal is. Avoid using any sort of clinical or industry-specific terms that donors might not understand.

Your Board of Directors

To successfully start a nonprofit in Texas, the Texas Business Organizations Code requires that your nonprofit has at least three directors. You are allowed to have family members on the board, but if you’re starting a public charity, you’ll need a majority of board members to not be related to one another. Private foundations are allowed to have boards made up of all family members. The founder is allowed to be on the first board of directors (and often is!).

A board of directors makes big organizational decisions and plans for the future of the nonprofit. Your first board doesn’t need to be perfect, but they should be people who care about your cause and are able to handle the commitment of being on a board for a few years. Your board can provide insightful advice, help with fundraising and help make key decisions about the goals and programs of the nonprofit. Each board is a little different but there are some responsibilities that are consistent for all nonprofit boards. You’ll want a few board members to also be officers– like the Treasurer or Secretary.

How to recruit your board of directors in Texas:

- Determine Needs: Find out what skill sets might be useful to have on your board.

- Network and Outreach: Reach out to friends, coworkers, or even people you meet at events or in the community who care about your cause.

- Engage and Inform: Explain to potential board members the goals, objectives, and mission of your nonprofit.

Funding

Before you dive into starting a nonprofit in Texas, it’s a great idea to think about how much it will cost to start the organization. Even if you’re starting small, there are always costs to starting a nonprofit. Whether you’re funding it yourself or asking for friends, family or board members to pitch in, there are many ways to cover the cost of getting started. Do note that most grant providers don’t fund brand new organizations. Typically, grant providers want to fund organizations with a proven track record.

When considering the cost of starting up, think about what you’ll need to run the program (supplies, staff, etc) and how you’ll get the word out to the public (a website, events, social media, etc.).

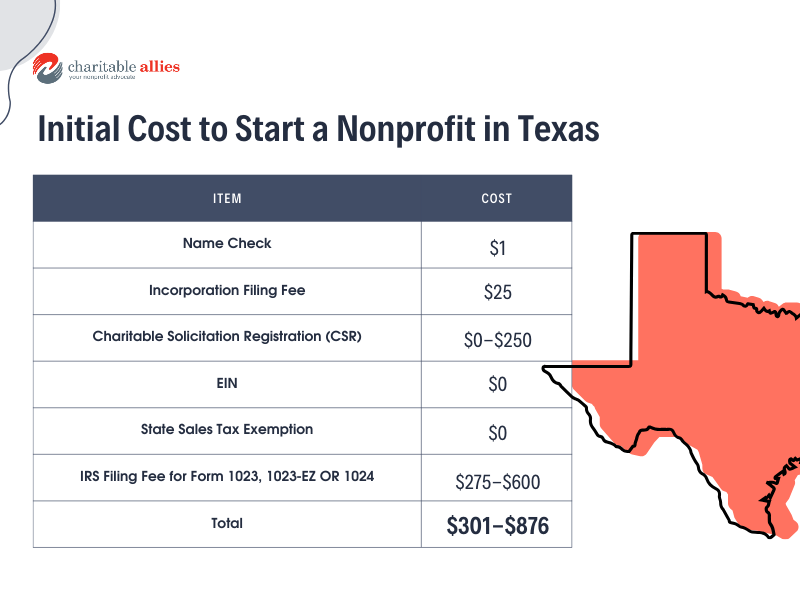

How much does it cost to start a nonprofit organization in Texas?

Once you move forward from wondering how to start a nonprofit in Texas to actually taking the leap, plan for these expenses at the very least:

- Checking to see if the name you want is available: $1 search fee

- Incorporating in Texas : $25 filing fee with the Texas Secretary of State Corporations Division

- Charitable Solicitation Registration: $0 unless your nonprofit is related to veterans or public safety. Veterans organizations’ registration is $150 and public safety organizations’ is $250.

- EIN Filing Fee: $0

- State Sales Tax Exemption: $0

- Filing with the IRS for tax exempt status: $275-$600 (see below for details)

Total: $301-$876

If you’re looking to have someone complete the process of starting a nonprofit organization in Texas for you, please reach out to us. Our legal team is happy to assist. Our comprehensive packages start at $1925, including the filing fees listed above.

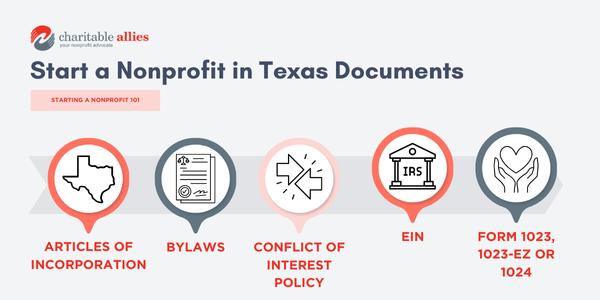

How to Start a Nonprofit in Texas Step 2: Incorporate

Once you’ve prepared and you have three board members, it’s time to incorporate your nonprofit in Texas. Before filing, you need to check to make sure the name you have in mind for your nonprofit is available. Texas charges a $1 search fee. After this you’ll file your Articles of Incorporation (also called Certificate of Formation) with the state of Texas. The filing fee for this document is $25, with a wait time for online processing of 1-2 hours. You can also file by mail with a 1-2 business day wait time (plus shipping time).

Note: Including a suffix in your organization’s name such as “Inc.” or “Co.” is not required by the state of Texas.

What information is included in the Articles of Incorporation?

-

- Nonprofit Name: This must be different from any other organization.

- Nonprofit Address: Many use the address of one of their board members.

- Names and Addresses of Board of Directors: You’ll need to list each board member and their address. You are allowed to have board members who live out of state, but you do need to have at least one board member who lives in Texas unless you’re using a professional registered agent.

- Name and address of incorporators: This is the person who will be listed as your incorporator. For most people, this is your founder.

- Purpose: Craft your “statement of purpose” to capture your nonprofit’s mission. Describe your goals clearly enough to show their charitable nature, but keep it broad enough to allow for future growth and program development.

- Effective date: This is the date you want your filing to be effective, you are allowed to file up to a 90 day delay.

- Supplemental Information: This is where you can add any information not required by the state that might provide additional benefit to your organization. This is a great place to add the additional information the IRS will look for when you go to file for your 501c3 status (or other tax exempt status). For example, you could use this space to include a dissolution clause stating if your nonprofit shuts down it will distribute its assets to related nonprofit organizations, which the IRS requires. Note: This is publicly held information so anything you include will be put on a public record.

These filings can often be daunting, so if you’d like help with these filings, request a free consultation here.

How to Start a Nonprofit in Texas Step Three: Creating Bylaws and other Corporate documents

EIN

An EIN, or Employer Identification Number, is a distinct nine-digit number assigned by the IRS for tax-related purposes. If you want to start a nonprofit in Texas, you need an EIN to open a bank account, employ staff, and get tax exempt status. To obtain an EIN, fill out the application form on the IRS website, which requires information about your nonprofit’s legal structure and purpose. Once you submit the form electronically, you will receive your EIN instantly. Applying for an EIN is free, but ensure your nonprofit is officially incorporated in your state before you apply.

Bylaws

Nonprofit organizations are governed by an official set of rules called bylaws. Bylaws are legally binding, so it’s key to make them easy to understand and follow. Bylaws are essential because they determine how decisions are made and conflicts are resolved. A great set of bylaws can help your nonprofit avoid risk and liability. When it comes to legal concerns, it’s your bylaws that have the final word.

Bylaws often answer questions like…

- How long will a board member serve on the board?

- Can we remove a board member if necessary? How?

- What needs to happen if the nonprofit ever closed its doors permanently?

- When does the nonprofit’s fiscal year start?

- Does our nonprofit have members? What are the rights and responsibilities of those members?

Your bylaws should cover more than this, but it’s a good jumping off point.

Conflict of Interest Policy

The conflict of interest policy outlines what a conflict of interest is and how to find out if there is a potential conflict. This policy should also outline how conflicts of interest get handled. It should be clear enough in defining the proper terms that you can identify potential stumbling blocks easily.

For example, if your nonprofit is hiring its first employee and that employee’s brother serves on the board that votes on the employee’s salary, that’s a potential conflict of interest. In that situation, most nonprofits would require the brother to recuse (or not vote) on that issue, while the rest of the board decides. The conflict of interest policy exists to make sure no one’s personal or business interests get in the way of them making decisions that are the best for the nonprofit.

OFAC Compliance Policy

If your nonprofit will do any work internationally, implementing an OFAC Compliance policy is crucial. The Office of Foreign Assets and Control (OFAC) regulates and ensures that US entities conducting international activities follow US government rules. We have a full article on best practices for nonprofits doing international work.

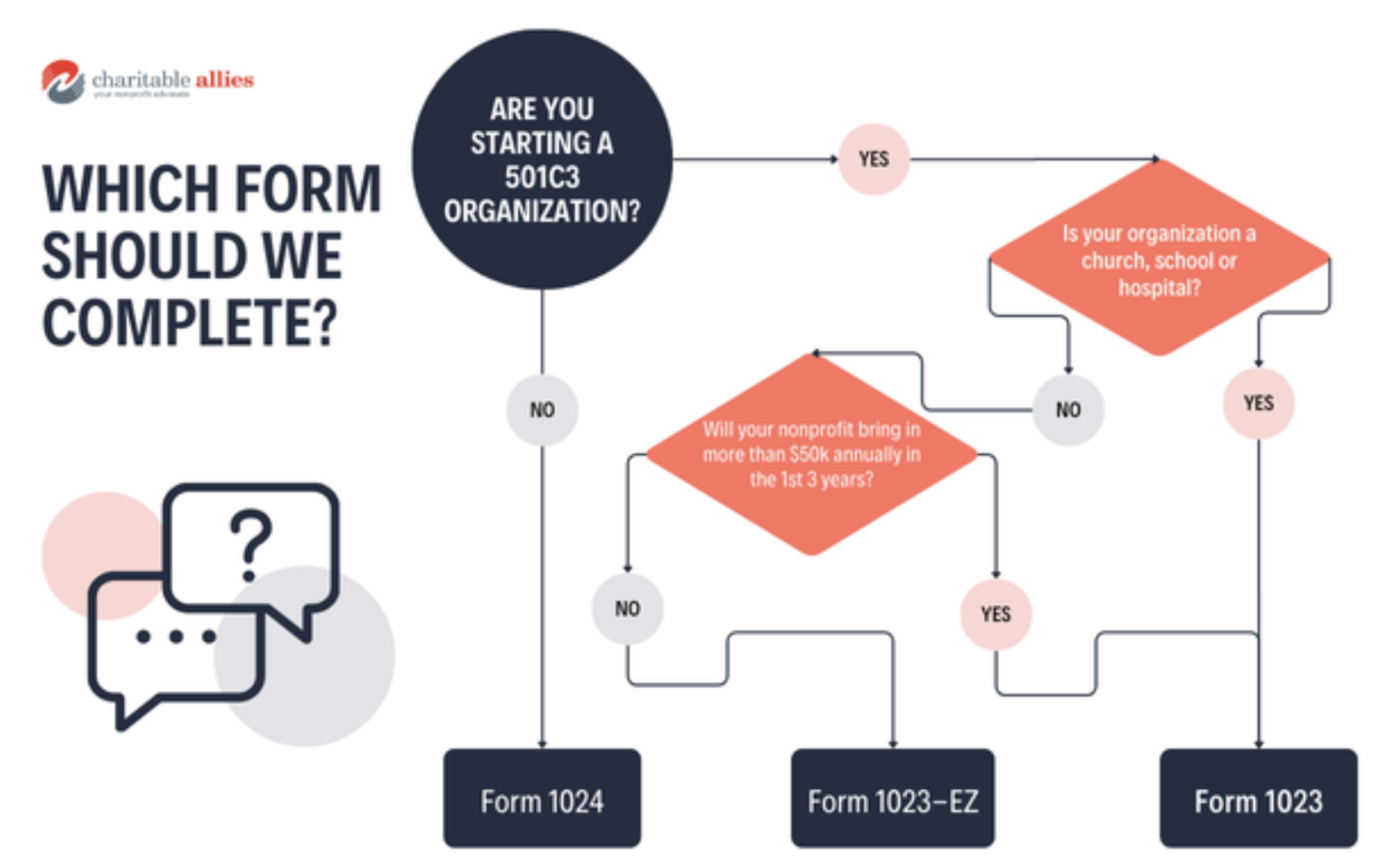

How to Start a Nonprofit in Texas Step Four: Achieving 501c3 (or Other Tax Exempt) Status

If you’re wondering how to start a nonprofit in Texas, you likely know you’ll need to file with the IRS. The IRS has three options for getting tax exempt status: Form 1023, Form 1023-EZ, or Form 1024. Each organization only needs to file one of these forms and there are requirements for which organizations should complete each form. No matter which form you file, if your organization is approved, you’ll get a determination letter. Keep that letter in a safe place. You’ll need it throughout the life of your nonprofit for everything from getting sales tax exemption to getting discounts from vendors.

Form 1023: The Full Application

Form 1023 is varied in length, depending on the type of organization you’re starting. Different types of organizations may be required to fill out different sections. Form 1023 can be lengthy and detailed, depending on what kind of nonprofit you’re starting. It asks for everything from basic info to a detailed budget projection. Filing costs $600, and the IRS usually takes between 6 to 10 months to process it. Keep in mind that churches, hospitals and schools are all required to file Form 1023 and are not eligible for the 1023-EZ.

Form 1023-EZ: A Simpler Option

For smaller nonprofits, Form 1023-EZ might be the way to go. If your organization isn’t a hospital, school, church, or another non-501c3 entity, and if you expect your revenue to be $50,000 or less per year for the first three years, this could be a great option. Form 1023-EZ is shorter, cheaper ($275), and quicker to process (about 1-2 months). There’s no downside to choosing this simpler form, so if your nonprofit meets the requirements for it, it can be a great way to save time and money.

Form 1024: For Non-501c3s

Not all nonprofits are 501c3s. If your organization fits into another category, like a social welfare group (501c4), social club (501c7), business league (501c6), cemetery (501c13), or a lodge/fraternal organization (501c8 or 501c10), you’ll need to file Form 1024. It also costs $600 to file, and the processing time is typically 7-10 months. For the most current processing times, check the IRS website.

Which form is right for me?

- Funding:

-

-

- How much funding do you have lined up from donors already?

- Do you expect to bring in any program service revenue?

- If the total of expected donations and program service revenue is under 50,000, you might be eligible for the 1023-EZ.

- Note: The IRS knows you don’t have a crystal ball. So if you don’t have funding lined up and you’re hopeful (but not sure) that you’re going to bring in more than $50,000 each year, Form 1023-EZ could be right for you. There is no penalty if you unexpectedly go over the $50,000 per year threshold. It will simply need to be reported on your annual filing to the IRS (Form 990).

-

- Type of Organization:

-

- Is your organization a church, hospital or school? If so, you must file Form 1023.

- Is your organization a tax exempt organization that will not be a 501c3? You’ll need to file Form 1024.

No matter which form you choose to file, if you’d like a helping hand, reach out! Our legal team has helped hundreds of nonprofits get started nationwide!

How to start a nonprofit in Texas Step 5: Additional Documents

If you want to know how to start a nonprofit in Texas, there are a few additional documents to consider. Thankfully, Texas streamlines the process of starting a nonprofit compared to many other states. Notably, Texas does not require all nonprofits to register for fundraising, a mandate found in almost every other state. Only veterans organizations and public safety organizations are required to register to fundraise.

Sales Tax Exemption in Texas

To qualify for a sales tax exemption in Texas, your nonprofit needs to complete a simple form called AP-205 and submit it. If your organization is unincorporated, please provide a copy of your governing document, such as the bylaws or constitution. There’s no fee to file this form, and it typically gets processed in less than a week.

Policies and Agreements for Your Nonprofit

Each nonprofit is different. What an animal rescue needs is very different than what an after school music program needs. Here are a few documents to consider, depending on your nonprofit’s mission and activities:

- Volunteer Agreement or Policies: Establish what’s required of your volunteers, what your nonprofit is liable or not liable for when someone is volunteering, and if your volunteers will be required to get a background check.

- Safety Policies: Protect the population you work with, your staff and volunteers by establishing safety policies. Though these are not glamorous documents, they can keep your programming safe, especially for any more vulnerable populations you serve like animals, the elderly, or children.

- Church-specific Policies: Churches often have a statement of faith, which is sometimes included in your initial incorporating documents. If you have a building, you might want a facility use agreement to control the use of church property in a manner consistent with their beliefs and practices.

No matter what type of nonprofit you’re aiming to start, we are here to assist you. Our legal team is dedicated to guiding you through every step of the process of starting a nonprofit in Texas. We take pride in supporting numerous nonprofits across the state from El Paso to Dallas. We look forward to helping you succeed.

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025

- Legal Advice for Nonprofits: When to Get Help and What’s at Stake - October 15, 2025