If you want to know how to start a nonprofit in Maine, look no further. In this article, we outline the essential steps you need to take to successfully launch a 501c3 nonprofit organization in Maine. We’ll cover all the basic steps from laying the groundwork to getting your 501c3 status. From Portland to Calais you can use this article to guide you through the startup journey. This can be a complicated and overwhelming process, so if you’d like help, reach out. Our legal team helps start nonprofit organizations nationwide.

How to Start a Nonprofit in Maine Step 1: Laying the Groundwork

If you want to know how to start a nonprofit in Maine, the first step is knowing what to prepare. This includes determining your mission, getting a board of directors, and figuring out funding.

Mission

First things first: get clear on your mission. Think about who or what you’ll be serving and how you’ll go about it. A great way to nail this down is by creating a mission statement. This doesn’t have to be a novel—just a sentence or two that answers a few key questions:

- Who or what are we serving?

- How will we serve them?

- What’s our ultimate goal? OR How will we know we’re successful?

Your mission statement should be easy to understand, even for someone who’s not familiar with your field. For example, if your mission involves scientific research, it’s a best practice not to put any industry terms in your mission statement. Use layman’s terms whenever possible. One good strategy is to look at the mission statements of similar organizations in other locations for inspiration. Most nonprofits have this information readily available on their websites, so a quick Google search will do.

The main goal is clarity. You want anyone who reads your mission statement to instantly grasp what your nonprofit does and what your goal is. Keep it simple! Focus on your core purpose and make it resonate with potential donors, volunteers and advocates.

Board of Directors

If you want to know how to start a nonprofit in Maine, you can’t do it solo! Maine requires every nonprofit to have a board of directors. The IRS has a few rules about this as well. You need at least three board members, and most of them should not be related to you or each other by blood or marriage. Basically this means your board can’t all be made up of family members or business partners of yours. But you’re welcome to have a family member on the board as long as there are enough people to outvote the related members on the board.

You can also have board members who don’t live in Maine. This is much more common now, when board meetings can be done via video call. Your initial board doesn’t have to be flawless, but it’s important to pick people who genuinely care about your mission and have the time to help you get things off the ground. A few of these board members will also need to take on officer roles like Board Chair or Secretary. In Maine, one person can hold more than one officer position if your bylaws allow it, but we usually recommend against it. It’s better to have different people handling different roles to avoid any hiccups if someone gets sick or needs to step away for a bit.

Funding

Though it’s possible to start a nonprofit inexpensively, there is not currently a way to start a nonprofit for free. Even if you’re kicking things off on a small scale, there are always some costs to consider. Here’s a rundown of what you’ll need to think about:

- Program Essentials: What do you need to get your programs up and running? Don’t forget to budget for materials and supplies.

- Staffing Needs: If you’re planning to hire anyone, make sure to include their wages and benefits in your budget. Many organizations don’t start out with paid staff members, but will get them later as the nonprofit grows. Volunteers can help keep costs low.

- Startup Help: If you want to bring someone on board to assist with the initial paperwork, plan for those costs. We can help start 501c3 organizations in Maine, so reach out if you’d like to speak with a member of our team about it.

- Online Presence: Investing in a website and branding materials can help get your message out there. Keep in mind that many potential donors and grant funders will look to see any website or social media presence you have to learn more about you!

- Fundraising Costs: Budget for any events or activities you’ll hold to raise donations.

- Special Services: If you need professional services like bookkeeping or grant writing, make sure to account for those.

Understanding these costs will help you set a realistic budget and keep your nonprofit running smoothly from the start. This list is not the end-all-be-all. Let’s dive into the filing fees charged by the state and the IRS next.

How Much Does it Cost to Start a Nonprofit in Maine?

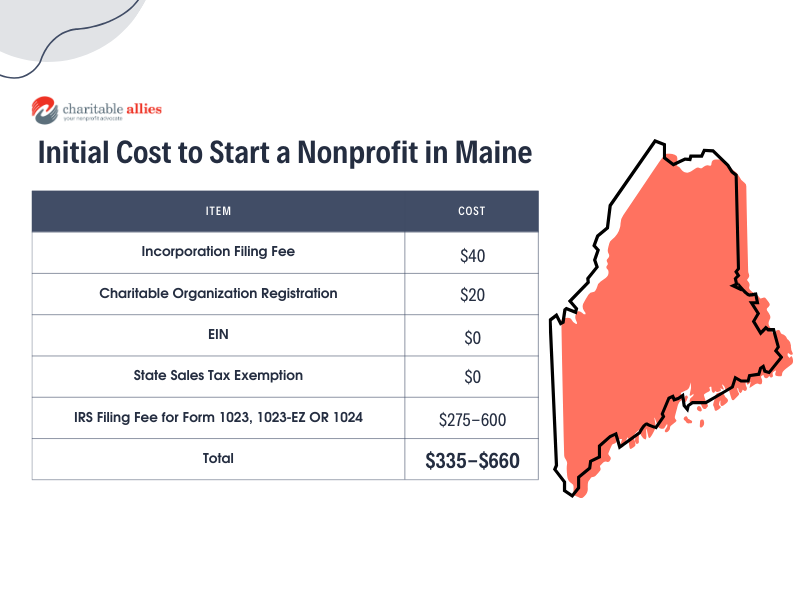

Before you start your nonprofit in Maine here’s a quick rundown of the costs you can expect:

- Incorporation: Filing your Articles of Incorporation with the Maine Secretary of State will set you back $40.

- Charitable Solicitation Registration: If you’re planning to solicit donations, you’ll need to register, which costs $20.

- EIN: Getting an Employer Identification Number (EIN) is free.

- Sales Tax Exemption: Applying for a sales tax exemption in Maine doesn’t have a fee.

- IRS Tax-Exempt Status: Filing for 501c3 status with the IRS ranges from $275 to $600, depending on the specifics of your application.

Expect to spend between $335 and $660. If you’d like to save time and have someone handle the setup and guide you through the 501c3 process, feel free to get in touch! Our team has helped thousands of nonprofits nationwide and would be happy to help you!

How to Start a Nonprofit in Maine Step 2: Incorporating

When you want to know how to start a nonprofit in Maine, filing your Articles of Incorporation is a key step. First, you’ll want to check if your chosen name is available by visiting the Maine Secretary of State’s website. Your name must be unique, so make sure another organization in Maine doesn’t have your name before filing!

Maine makes it easy with online filing, which we highly recommend to avoid the wait time that comes with mailing. The standard fee is $40. If you need to speed things up, you can opt for next-day service for $50 or same-day service for $100. Typically, we don’t suggest the expedited fee in Maine because the state usually takes less than a week to accept articles.

Also, Maine doesn’t require you to add a suffix like “Inc.” to your nonprofit’s name, but you’re welcome to include it if you prefer. If you have any questions or need a hand with the paperwork, feel free to reach out! We’ve successfully completed hundreds of Articles of Incorporation for nonprofits nationwide.

When you’re filling out the Articles of Incorporation in Maine, Include:

- Nonprofit’s Name: This needs to be unique. So make sure it isn’t already taken or too similar to another Maine business.

- Nonprofit Address: Provide the main address where your nonprofit will operate. Sometimes at the start, people will use a board member’s address if the nonprofit doesn’t have a building.

- Registered Agent and Address: Include the name and address of someone in Maine who will handle all the legal and official mail for your organization. Often, people will choose a board member for this.

- Incorporators: List who’s filling out your forms and starting the nonprofit, including their names and addresses.

- Directors: Finally, include the names and addresses of your initial board members.

How to Start a Nonprofit in Maine Step 3: Bylaws and Other Corporate Documents

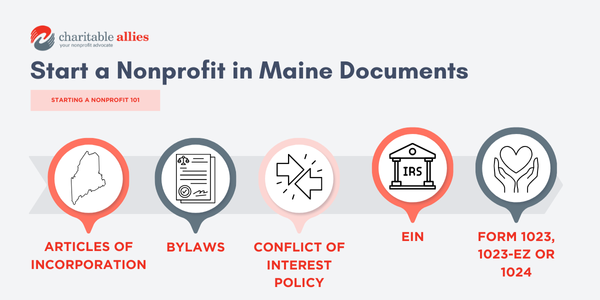

The next step is made up of several smaller steps. When teaching people how to start a nonprofit in Maine, we found the easiest way is to combine these small steps into one step we call the “corporate documents.” This includes bylaws, an EIN, a conflict of interest policy, and an OFAC compliance policy if you need it.

EIN (Employer Identification Number)

EINs are a simple but crucial step in the process. This nine-digit number is issued by the IRS and is crucial for tax purposes. You’ll need it to open a bank account, hire staff, and apply for tax-exempt status. To get one, just fill out the online application on the IRS website. You’ll need to provide some details about your nonprofit’s structure and goals. The best part? It’s free, and you’ll get your EIN right away. Just make sure your nonprofit is officially set up in Maine by getting your approved Articles of Incorporation back before you apply.

Bylaws

Next, you’ll need to create bylaws for your nonprofit. Essentially, these are the rules that govern how your organization operates. They are legally binding, so it’s important to make them clear and straightforward. Bylaws that are too restrictive or too vague can be difficult to follow. Great bylaws will discuss how decisions are made, how conflicts are resolved, and what happens if your nonprofit ever shuts down. Key provisions to include are:

- The length of time board members will serve

- How and when board members can be removed

- What happens if the nonprofit ever dissolves

- When your fiscal year starts

- Whether your nonprofit has members and what their rights and responsibilities are

Your bylaws should cover these basics and more. Read more about bylaws here.

Conflict of Interest Policy

A conflict of interest policy is key to maintaining fairness and transparency. It should clearly explain what counts as a conflict and how to manage it. For instance, if a board member’s relative is up for a job at the nonprofit, the board member should step aside from the decision-making process. This way, personal interests don’t get in the way of making the best choices for the organization. Good conflict of interest policies clearly define what constitutes a conflict of interest and what the nonprofit’s leadership can do if they suspect there might be one.

OFAC Compliance Policy

If your nonprofit will be working internationally, you’ll need an OFAC Compliance Policy. The Office of Foreign Assets Control (OFAC) oversees international activities to ensure they align with US regulations. This includes abiding by US sanctions and restrictions. There are certain countries that are more heavily regulated than others when it comes to what kind of aid you’re allowed to provide, such as North Korea. If you’re planning to work abroad, having a policy in place to comply with OFAC rules is crucial.

How to Start a Nonprofit in Maine Step Four: Achieving 501c3 (or Other Tax Exempt) Status

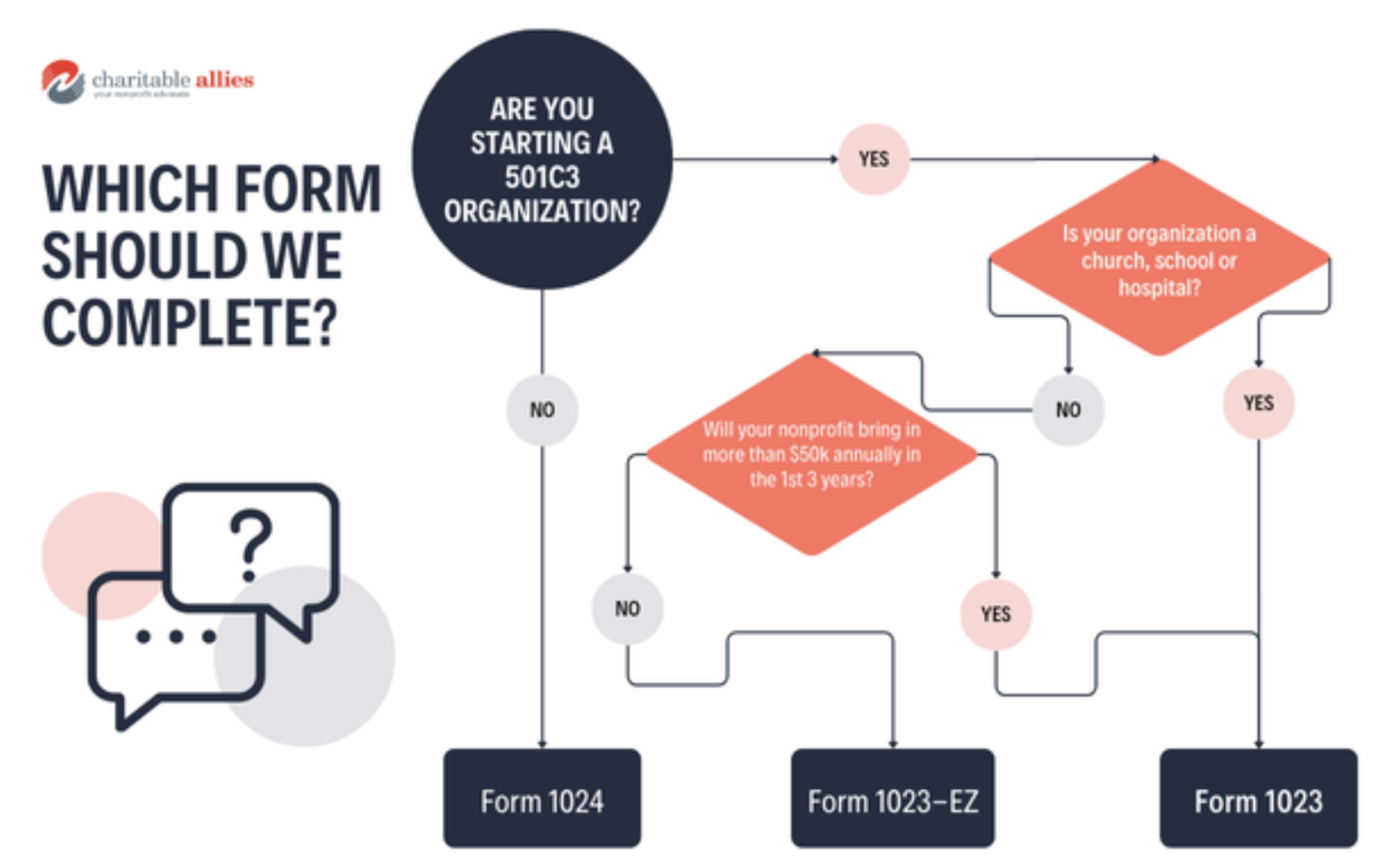

If you want to know how to start a nonprofit in Maine you’ll need to get your tax-exempt status with the IRS. There are three main forms, each suited to different types of organizations. Here’s a quick rundown:

Form 1023: The Detailed Option

Form 1023 is the most comprehensive of the three. It’s quite detailed and will ask for everything from your basic information to a thorough budget projection for your first few years of operation. The filing fee for Form 1023 is $600. The IRS usually takes around 6 to 10 months to process it. Note that certain organizations like churches, schools, and hospitals must use this form and can’t opt for the other versions.

Form 1023-EZ: The Streamlined Choice

If you’re running a smaller nonprofit that is not a hospital or school, Form 1023-EZ might be your best bet. It’s shorter, less expensive (just $275 to file), and the processing time is much quicker. Typically the IRS will get back to you in 1 to 2 months about the status of your 1023-EZ. This form is great if you expect to have under $50,000 in revenue per year (in your first few years) and less than $250,000 in assets.

Form 1024: For Other Types of Nonprofits

Not all nonprofits fit the 501c3 category. If your organization falls under different categories like a social welfare group, social club, or business league, you’ll need to file Form 1024. Filing the 1024 costs $600 with the IRS. Generally, it takes about 7 to 10 months to process. For the latest updates on processing times, it’s a good idea to check the IRS website.

Once you get your tax-exempt status, be sure to keep the determination letter safe. The determination letter is what the IRS sends you to confirm your organization is officially a tax exempt nonprofit organization. You’ll need it for various things, from applying for sales tax exemptions to getting discounts.

Which Form is Right for Me?

So which form should you file?

If you already have donations lined up or expect to bring in revenue from your programs, that’s great! Calculate how much you think it will be per year. For example, a youth soccer league can multiply their equipment and jersey fee they charge families by how many kids will participate. Then they’d add in how much in grant funding or donations donors have already promised them.

If you’re anticipating less than $50,000 in total annual revenue and less than $250,000 in assets within the first 3 years, Form 1023-EZ might be a good fit. Or if you don’t have any funding lined up yet, and you are not starting a church or school, the 1023-EZ could still be right for you. The IRS understands that predictions aren’t always perfect. If you end up going over the $50,000 mark, you just need to report it in your annual IRS filing (Form 990). There are no penalties for unexpected growth as long as you report it correctly and are still utilizing funds for your charitable mission.

If you’re feeling a bit overwhelmed or just want some help navigating this process, don’t hesitate to reach out. Our nonprofit attorneys have helped many nonprofits get started across the country and would be happy to assist!

How to Start a Nonprofit in Maine Step 5: Additional Documents

Charitable Solicitation Registration

In Maine, you have to register with the Maine Office of the Attorney General before you start fundraising. This is a must for any nonprofit looking to collect donations in the state. Charitable solicitation registration (CSR) is essentially a permission slip that allows you to solicit donations in your state. Laws haven’t kept up with the times in many states though, so if you’re planning on asking people for donations who live in other states, check the requirements for those states. In Maine, there’s an initial fee of $20 when you first register, and an annual fee of $20 to keep your registration active.

Sales Tax Exemption in Maine

It’s a common misconception that once nonprofits have their determination letter, they don’t have to pay taxes on anything. To avoid the Maine state sales tax, file for an exemption, free of charge! Getting sales tax exemption in Maine is pretty straightforward:

- Check Eligibility: Make sure your nonprofit qualifies for exemption.

- Prepare Documents: You’ll need your IRS tax-exempt letter.

- Fill Out Form ST-4: This is the Sales Tax Exemption Application from Maine Revenue Services.

- Submit It: Send the form and documents to Maine Revenue Services.

- Get Your Certificate: Once approved, you’ll get a certificate to use for tax-free purchases.

Policies and Agreements for Your Nonprofit

Every nonprofit has unique needs based on what they do. For example, an animal rescue will have different requirements than a church. Here are some documents you might need, depending on your nonprofit’s focus:

- Volunteer Guidelines: Outline what volunteers need to do, what your nonprofit is responsible for, and whether volunteers need background checks.

- Safety Procedures: Create safety protocols such as background checks to protect everyone involved, including the people you help, your staff, and volunteers. These might not be exciting, but they’re crucial for keeping your activities safe, especially if you work with vulnerable groups like animals, kids, or the elderly.

- Church-Specific Rules: If you’re a church, you might need a statement of faith and a facility use agreement. These documents help manage how your church property is used in line with your beliefs.

- Adoption Agreements: If you are starting an animal rescue that plans to adopt out animals, you’ll want an adoption agreement. Adoption agreements should cover the terms of the adoption, including what someone needs to do if they are unable to care for the animal properly.

This is not an extensive list. Each nonprofit is different and will have unique needs when it comes to policies and documents.

With over a decade of experience serving nonprofits exclusively, our legal team has helped launch thousands of nonprofits across the nation. From Portland to Bangor, we’re here to support you through every step of the process. Reach out for a free initial consultation today!