Many families find that homeschooling aligns with their family’s schedules and values better than other educational institutions. Contrary to the common misconception, homeschooling families often enjoy supplementing their children’s academics with a wide variety of social and educational activities, such as homeschool sports teams, hobby clubs, and co-ops alongside other homeschooled peers.

If you’re thinking of starting one of these nonprofit homeschool organizations or a similar type of group, there are multiple ways your organization can structure itself to receive the benefits of tax exemptions and donations. In this article, we’ll be discussing a few of those options, as well as the pros and cons you may want to consider.

Should My Homeschool Co-Op File for 501c3 Tax Exempt Status with the IRS?

Though it is not a requirement, many homeschool organizations consider filing as a 501c3 nonprofit with the IRS. 501c3 status is the most common IRS designation for a tax exempt nonprofit organization, which means your homeschool group would be considered federally tax-exempt and could accept tax-deductible donations, receive discounts from businesses and products, and apply for grants. Donors and companies will often forgo gifts or discounts for organizations that do not have 501c3 status, as it comes with a level of trust and accountability (for example, Staples offers a variety of perks for eligible nonprofits). If your co-op or organization’s purpose is educational, religious, or charitable in nature, this status is likely the best fit.

If your group’s focus is more recreational or if it fits the description of a support group, 501c7 status is a similar status meant for social clubs that do not have the benefit of accepting tax deductible donations. This arrangement is not as common as 501c3 organizations. You’ll want to keep in mind that 501c7 organizations typically are more selective about members, as opposed to being open to the public. 501c7s often have membership fees and voting privileges in the organization. But you’ll want to consider the pros and cons of having legal members before adopting this structure.

No matter what type of tax exemption is right for you, filing with the IRS does require a level of administrative and financial responsibility.

These responsibilities include:

- The requirement to have at least 3 people listed as the board of directors, each with real obligations to making sure the organization is maintained properly and staying true to its mission

- The process of applying for the status itself, which can be expensive and time-consuming process depending on your budget and manpower

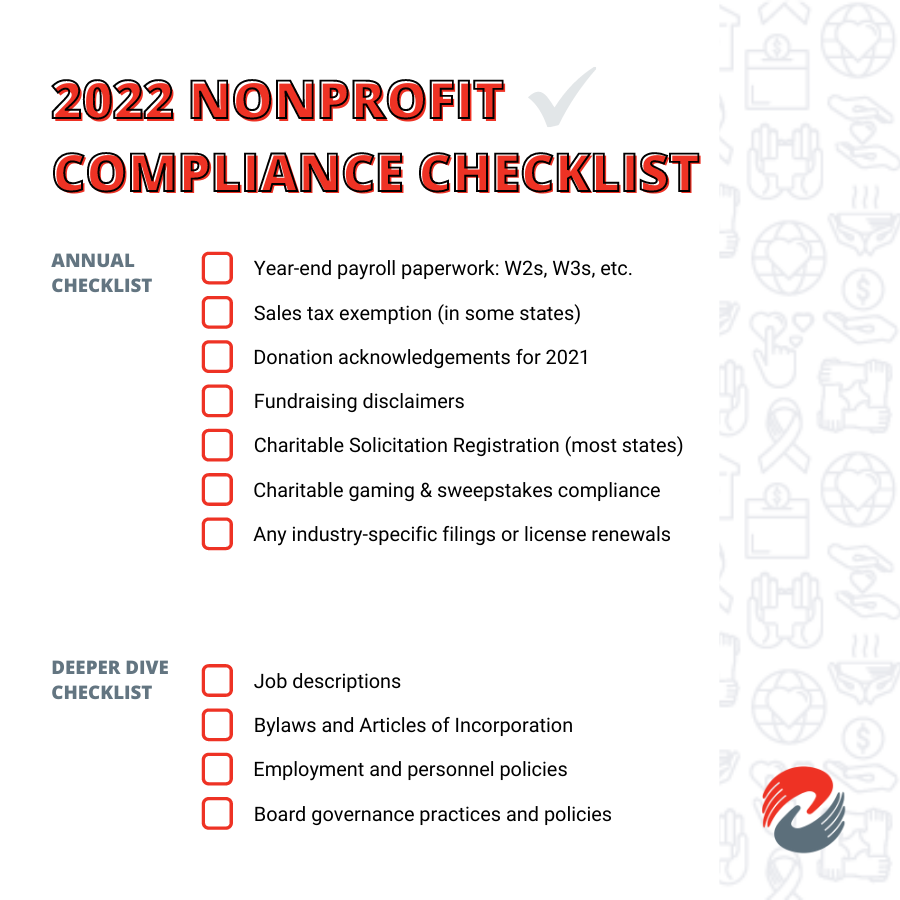

- The duty to file the necessary paperwork to remain compliant with IRS regulations, such as annual 990 tax filings and state-level registrations to legally solicit donations (known as Charitable Solicitation Registration)

We’re proud to report we’ve helped over 400 nonprofits nationwide get their tax exempt status quickly and with ease. But there are other ways you may want to bring your organization to life legally if this designation doesn’t suit your group’s needs.

Can My Homeschool Group Operate Under Another Organization’s Tax Exempt Status?

If your homeschool group or co-op isn’t ready for the administrative burden of keeping up a 501c3 nonprofit, you’re certainly not alone. An alternative option we commonly see is a homeschool group partnering with an established, separate nonprofit in order to operate under their tax exempt status.

For example, if a group of homeschool families want to come together to offer educational programming for homeschool students in their area, they might partner with an existing 501c3 (say, a church) that is willing to accept donations on their behalf. This relationship may also lead to the sharing of space and resources, depending on the agreement. Fiscal sponsorship is one of the most common versions of this partnership that we see for smaller groups who want to provide programming without being a standalone organization.

A fiscal sponsorship relationship can come with many benefits, such as:

- The ability to receive tax deductible donations without having to file for tax exempt status or upkeep your own charitable solicitation registration

- A relationship with a known and trusted 501c3 nonprofit in the community

- Less administrative burden in general, depending on the degree of independence the sponsorship relationship

If your homeschool group or co-op doesn’t have a church, school, or other 501c3 in your network willing to provide this relationship, there are also organizations that exist for the sole purpose of being a fiscal sponsor. Our sister organization, Fiscal Sponsorship Allies, is one of these organizations. They’ve been known to fiscally sponsor certain homeschool groups using a Model C sponsorship model. You can learn more about the different models of fiscal sponsorship, as well as the pros and cons, here if this route seems best suited for your organization.

One drawback to operating under another organization’s tax exempt “umbrella” is that the 501c3 is typically the one that gets to set the terms and conditions of the relationship. Since they are shouldering the responsibility to the IRS and putting their own status on the line, they may have specific requirements and reporting expectations that they ask you to follow. Your homeschool group may not always have complete control over when it receives its funds or as much insight as you might like as to who you donate to. But this can also be a blessing—some homeschool groups may enjoy the structure and predictability this arrangement provides.

Should My Homeschool Group Be Fiscally Sponsored or Start its Own Nonprofit?

If your homeschool group or co-op does not want to handle oversight from the IRS or state fundraising regulations at all, fiscal sponsorship might be the best fit for you. You have the option to get started officially on the state level only in order to open a bank account and protect against personal liability, then let the fiscal sponsor handle CSR, donor management, and other administrative tasks depending on the model.

We hope this chart outlining the pros and cons of starting your own 501c3 nonprofit vs. using a fiscal sponsor is helpful to you. If you’d like additional information to make an informed decision, let us know and we’d be happy to provide further education on this topic.