At the start of every year, many nonprofit organizations wisely take time to regroup and assess what worked and what didn’t in the previous year. Now is also an excellent time to review compliance requirements that some nonprofits inadvertently overlook.

This checklist can be very helpful in making sure your organization is off to a good start. Taking the time to assess your organization is a valuable tool enabling you to avoid distracting inquiry letters from regulatory agencies as well as awkward conversations among nonprofit management and boards of directors.

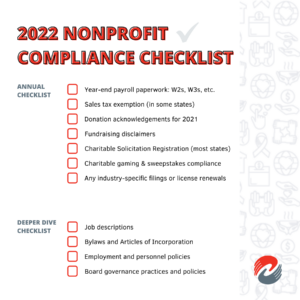

Basic Compliance Review Checklist

Most nonprofit organizations should review each of these items annually to ensure maximum compliance and minimum administrative cost and risk.

• Year-end payroll paperwork – These include federal W2s & W3s, state W2 and WH-3, federal 940/941/944 filings, ensuring your employee’s W4s and WH-4s are current, and ensuring your independent contractor paperwork is in order (i.e., 1099s and W9s).

• Sales tax account for my organization’s sales – Be sure to review whether you are required to remit sales tax to the Indiana Department of Revenue for all sales of merchandise or goods (IC 6-2.5), with some narrow exemptions (45 IAC 2.2-5).

• Donation receipting & contemporaneous written acknowledgments – Donors are required to obtain from charities specific acknowledgments of donations. Be sure you provide these no later than April 15, but preferably no later than January 31.

• Fundraising disclaimers – Many states require a disclaimer on all solicitation material. This is known as the Uniform Disclosure Statement and should be on your website and in your printed fundraising material. In addition, the IRS disclaimer (“Donations to [organization name] are tax deductible for Federal income tax purposes.”) should appear before the state disclaimers.

• Charitable solicitation registration review – More than 40 states require registration with the Attorney General of that state in order to conduct charitable solicitation in that state, commonly prior to any solicitation. While Indiana is not one of them, it does require registration for paid solicitors and consultants.

• Charitable gaming & sweepstakes compliance – Do you conduct any game of chance whatsoever, regardless of whether it has a buy-in? If so, you may be required to follow state gambling or sweepstakes laws.

• Industry-specific filings – Do you have any industry-specific filings (i.e., fire marshal filings for volunteer fire departments; department of health filings for clinics)? If so, be sure your accounts and filings are current.

In-Depth Compliance Review Checklist

Depending on your activities and whether you are in a period of transition now may also be an excellent time to more thoroughly review some other potential issues for major compliance concerns. In addition to the above, you should also be reviewing and/or updating:

• Job descriptions – Do your job descriptions accurately reflect the work those employees each do? Do the job descriptions include a catch-all “whatever employee is assigned” phrase? If not, it may be time to update these.

• Bylaws and articles of incorporation – Are they consistent with each other? Are they consistent with your other operation and administrative policies and procedures? Do any or all of them reflect what is actually occurring? If no to any of these, it is time to make some revisions.

• Personnel and employment policies – Is your handbook up to date? Do you promise 12 weeks of FMLA leave but only have 10 employees? Can you afford this? Are you following your handbook practices and procedures? If no to any, then it may be time to make some revisions.

• Board governance practices – There is no one-size fits all here, but, at the core, does your Board know of and adhere to its three legal duties: loyalty, care, and obedience? Is it actively engaged in the life of your organization? It may be time for a serious discussion with your upper management or Board leaders to breathe life back into your organization.

Through this annual assessment process, many organizations find at least one issue that they need to address. But many nonprofit managers and board members don’t know where to go for cost-effective, experienced and sophisticated legal advice. For specific legal advice, we at Charitable Allies are available to assist you with this review process and, where necessary, implementing changes to ensure the continued viability of your organization.

Charitable Allies provides all manner of legal and educational services for boards, officers management and staff of myriad charities throughout the sector. From basic one-time questions about a single matter to training for boards and officers to complex reorganization or merger of activities, Charitable Allies is your go-to cost-effective provider of legal services to nonprofit organizations.

Any advice contained in this article is merely general in nature and should not be taken as specific legal advice for your situation.

- Unrelated Business Taxable Income: What Nonprofits Need to Know for 2026 Filing - January 16, 2026

- Structuring Multi‑Site Churches and Expanding Ministries: Legal Essentials for Growth - November 26, 2025

- How to Launch a Grantmaking Foundation or Scholarship Fund (Without the Guesswork) - November 11, 2025