If you get a notice from the IRS that your nonprofit status has been revoked, your 501(c)(3) status is no longer active. This can prevent you from applying for grant funding, obtaining gifts from companies, and securing funding from donors. Nonprofits lose tax exempt status automatically after 3 consecutive years of not filing their annual return (also known as the 990). From the middle of 2010 to the end of 2017, the IRS revoked the tax-exempt recognition of more than 760,000 nonprofit organizations for that reason. If you want to learn more about auto-revocation and how to avoid it, we have a full article about it here.

So how do you get 501c3 status back?

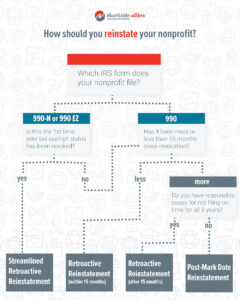

To regain 501(c)(3) status, you’ll go through a process called reinstatement. There are four types of reinstatement, which we’ll break down below. No matter which type of reinstatement you’d like to pursue, we have nonprofit attorneys who are happy to help with any of the options and with identifying which option could be right for your unique circumstance. Request a consultation with a member of our legal team to learn more.

Types of Reinstatement

- Streamlined Retroactive Reinstatement

- Retroactive Reinstatement Within 15 Months of Revocation

- Retroactive Reinstatement (more than 15 months after of revocation)

- Post-Mark Date Reinstatement

Streamlined Retroactive Reinstatement

If your organization files the 990-N or the 990-EZ (see chart below for details) and this is the first time your tax exempt status has been revoked, you can use this first method: Streamlined retroactive reinstatement. Any of the three types of retroactive reinstatement allows donations you received during the time your status was revoked to be retroactively tax deductible. Essentially, that means your donations will still be tax deductible for donors, even if they donated during the period of time your tax exempt status was revoked.

Note that for organizations filing the 990 -EZ, you will have to complete the form for the years it wasn’t filed. 990-N organizations do not have to complete the past forms.

Retroactive Reinstatement Within 15 Months of Revocation

If your nonprofit has more than $50,000 in annual revenue, or if this is not the first time the tax exempt status has been revoked, retroactive reinstatement could be right for you. If it’s been less than 15 months since your tax exempt status was revoked, the process is a little easier. You will still need to complete and file the missing 990 forms, and the appropriate form for tax-exempt status like the 1023 or 1024, along with the fee for submitting that form.

With retroactive reinstatement, be aware that you’ll also need what’s called a Reasonable Cause Statement, which is a written statement that provides the IRS explanation as to why you were unable to file the annual return at least one of those years.

Retroactive Reinstatement (more than 15 Months from Revocation)

If your nonprofit’s 501(c)(3) (or other 501(c) status) was revoked more than 15 months ago, you’ll follow the same process as the retroactive reinstatement process above, with the added caveat that you’ll have to give reasonable cause for why the annual return wasn’t filed for all three years it wasn’t filed. If you don’t have reasonable cause for why you weren’t able to file the appropriate 990 for those years, you’ll need to file for post-mark reinstatement.

Post-Mark Date Reinstatement

Post-mark reinstatement is different from the other three types because it isn’t retroactive, which means that donations you receive while your tax exempt status is revoked will not be tax deductible, even once you have your status reinstated. Only donations you receive moving forward after reinstatement would be tax-deductible. Post-mark reinstatement involves filing the 1023 or 1024 form with the IRS and paying the appropriate fee for it.

It can be a difficult and lengthy process for newcomers to reinstate the status of their nonprofit organization, but with the help of a knowledgeable nonprofit attorney, the process doesn’t have to be daunting! Reach out to us for a free consultation to speak about which kind of reinstatement could be right for your nonprofit organization.